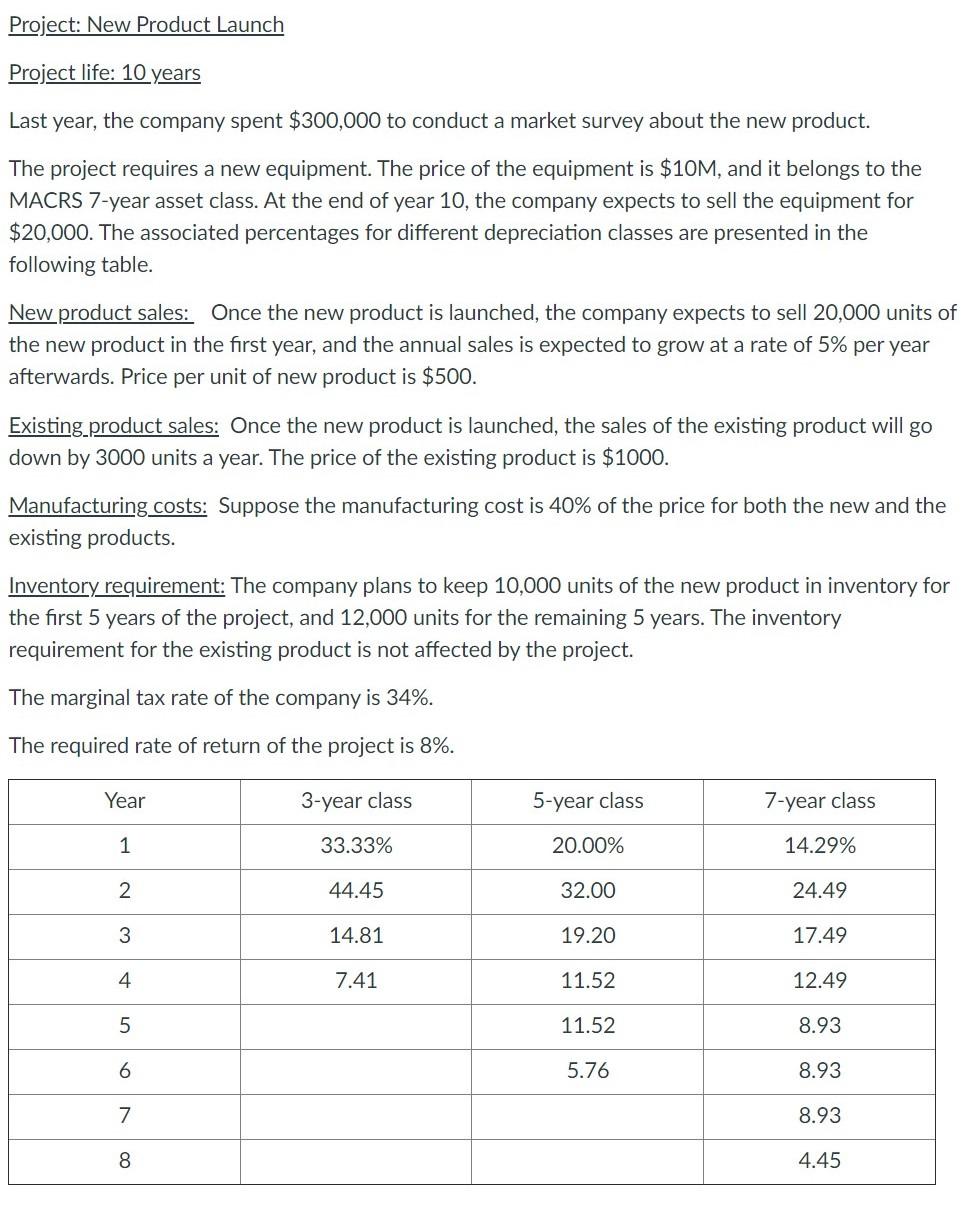

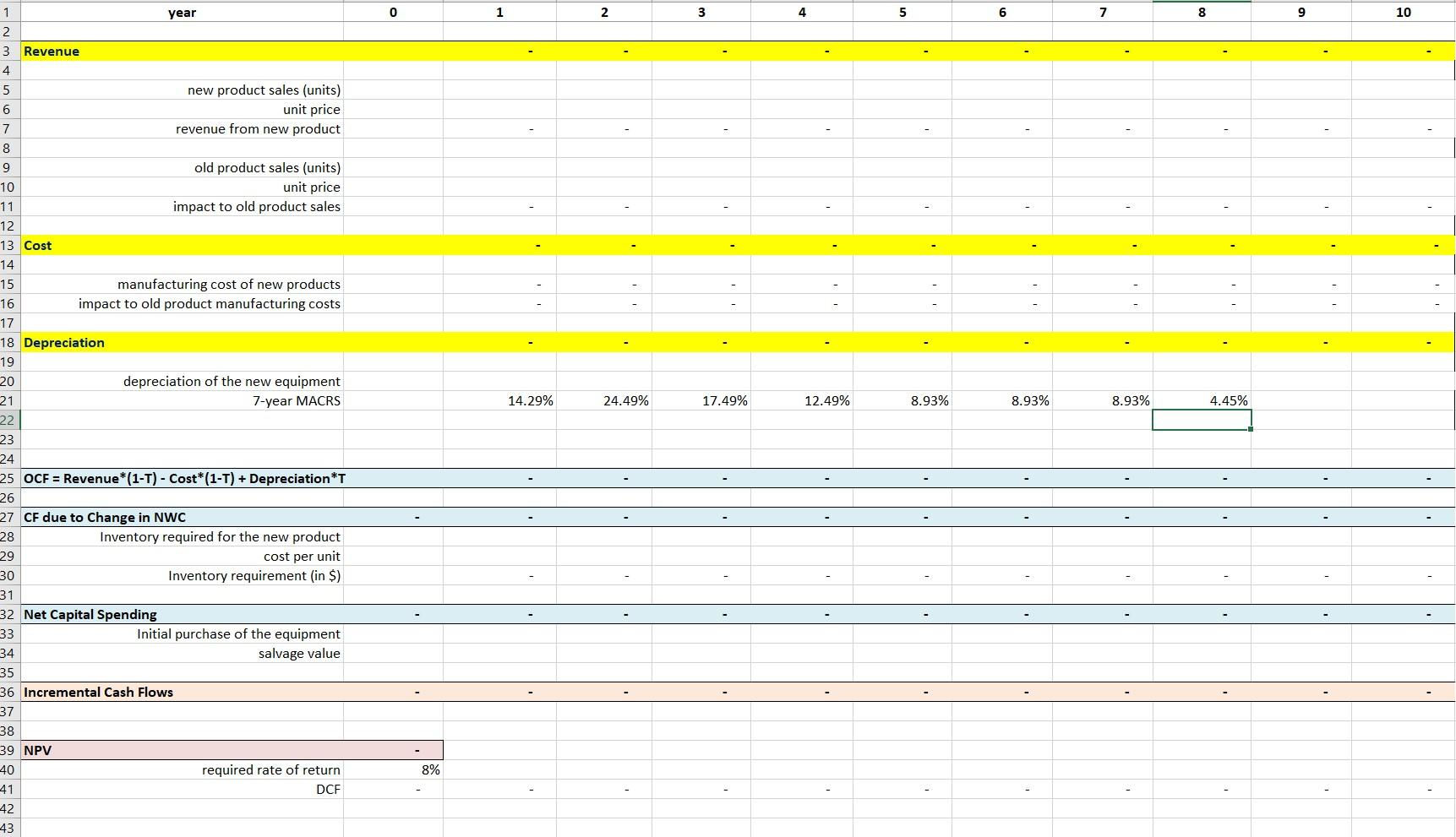

Question: year 0 1 2 3 4 5 6 7 8 9 10 1 2 3 Revenue 4 . 14.29% 24.49% 17.49% 12.49% 8.93% 8.93% 8.93%

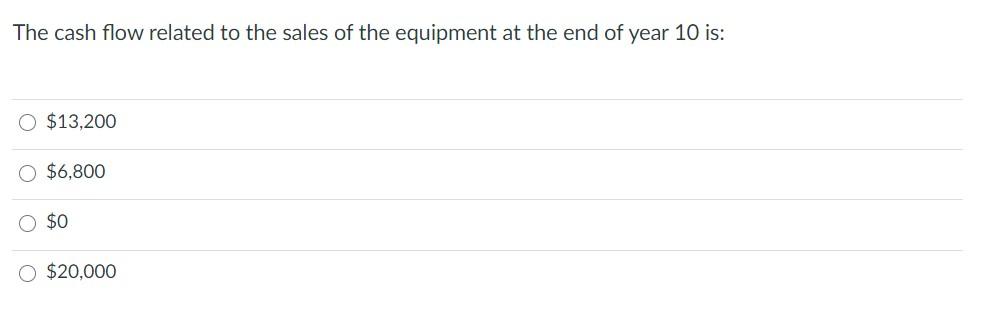

year 0 1 2 3 4 5 6 7 8 9 10 1 2 3 Revenue 4 . 14.29% 24.49% 17.49% 12.49% 8.93% 8.93% 8.93% 4.45% 5 new product sales (units) 6 unit price 7 revenue from new product 8 9 old product sales (units) 10 unit price 11 impact to old product sales 12 13 Cost 14 15 manufacturing cost of new products 16 impact to old product manufacturing costs 17 18 Depreciation 19 20 depreciation of the new equipment 21 7-year MACRS 22 23 24 25 OCF = Revenue*(1-T) - Cost*(1-T) + Depreciation *T 26 27 CF due to Change in NWC 28 Inventory required for the new product 29 cost per unit 30 Inventory requirement (in $) 31 32 Net Capital Spending 33 Initial purchase of the equipment 34 salvage value 35 36 Incremental Cash Flows 37 38 39 NPV 40 required rate of return 41 DCF 42 43 8% The cash flow related to the sales of the equipment at the end of year 10 is: O $13,200 O $6,800 0 $0 $20,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts