Question: undefined risk free rate 5% QUESTION 2 The standard deviation of the market portfolio is 15%, the beta of Asset 2 is 0.37 and its

undefined

undefined

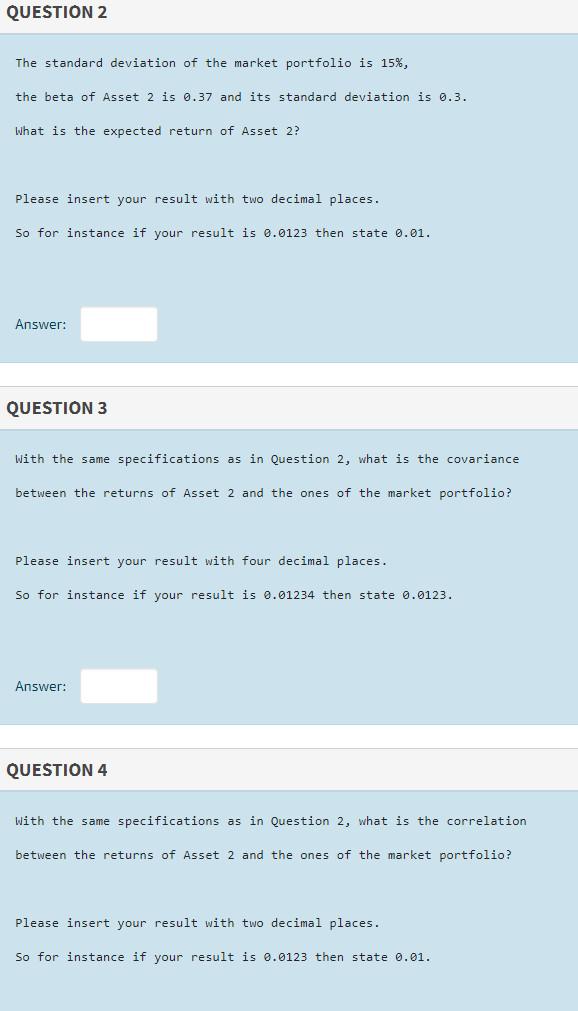

QUESTION 2 The standard deviation of the market portfolio is 15%, the beta of Asset 2 is 0.37 and its standard deviation is 0.3. What is the expected return of Asset 2? Please insert your result with two decimal places. So for instance if your result is 0.0123 then state 0.01. Answer: QUESTION 3 With the same specifications as in Question 2, what is the covariance between the returns of Asset 2 and the ones of the market portfolio? Please insert your result with four decimal places. So for instance if your result is 0.01234 then state 0.0123. Answer: QUESTION 4 With the same specifications as in Question 2, what is the correlation between the returns of Asset 2 and the ones of the market portfolio? Please insert your result with two decimal places. So for instance if your result is 0.0123 then state 0.01. QUESTION 2 The standard deviation of the market portfolio is 15%, the beta of Asset 2 is 0.37 and its standard deviation is 0.3. What is the expected return of Asset 2? Please insert your result with two decimal places. So for instance if your result is 0.0123 then state 0.01. Answer: QUESTION 3 With the same specifications as in Question 2, what is the covariance between the returns of Asset 2 and the ones of the market portfolio? Please insert your result with four decimal places. So for instance if your result is 0.01234 then state 0.0123. Answer: QUESTION 4 With the same specifications as in Question 2, what is the correlation between the returns of Asset 2 and the ones of the market portfolio? Please insert your result with two decimal places. So for instance if your result is 0.0123 then state 0.01

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts