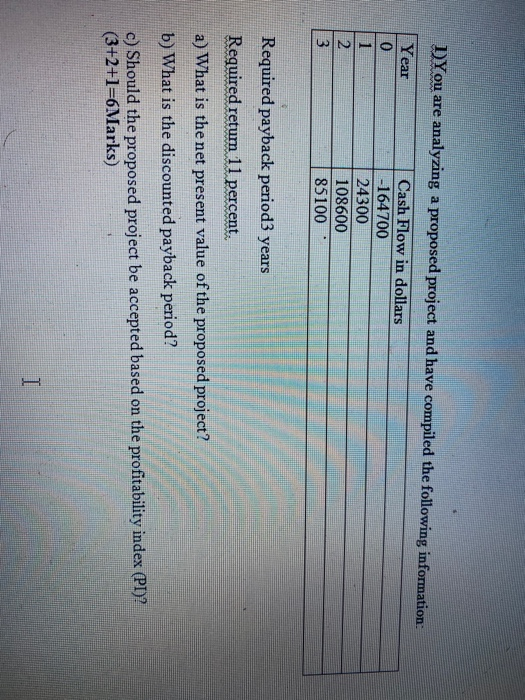

Question: Year 1)You are analyzing a proposed project and have compiled the following information: Cash Flow in dollars -164700 24300 108600 85100 Required payback period3 years

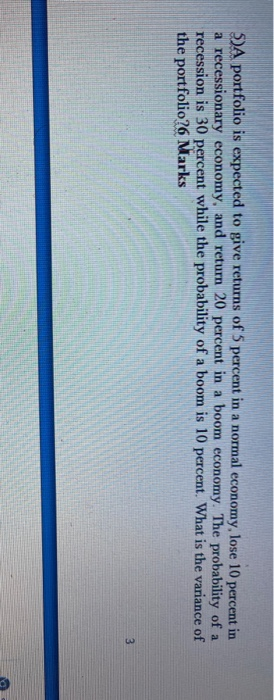

Year 1)You are analyzing a proposed project and have compiled the following information: Cash Flow in dollars -164700 24300 108600 85100 Required payback period3 years Required retum 11 percent. a) What is the net present value of the proposed project? b) What is the discounted payback period? c) Should the proposed project be accepted based on the profitability index (PI)? (3+2+1=6Marks) 5)A portfolio is expected to give returns of 5 percent in a normal economy, lose 10 percent in a recessionary economy, and return 20 percent in a boom economy. The probability of a recession is 30 percent while the probability of a boom is 10 percent. What is the variance of the portfolio?6 Marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts