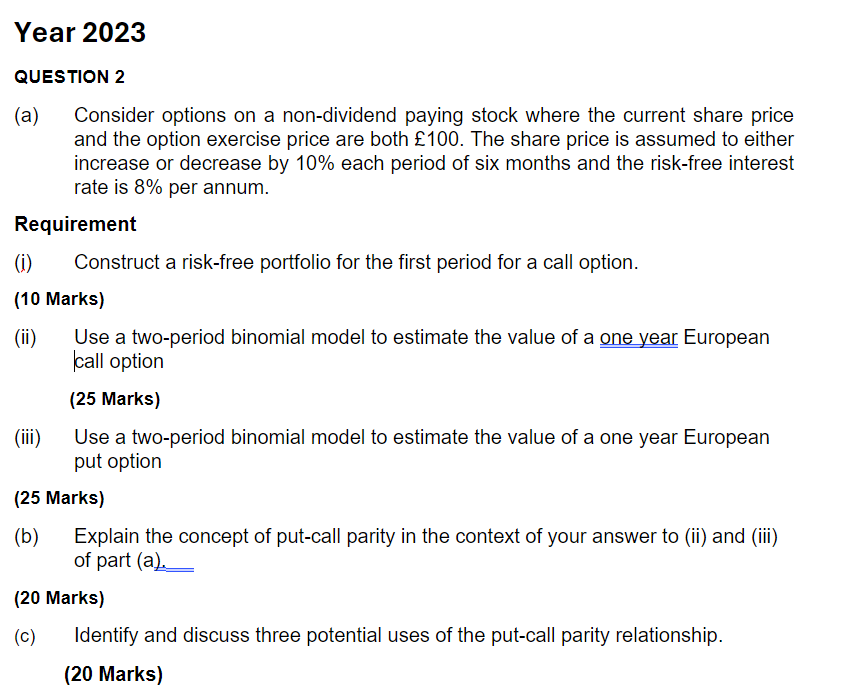

Question: Year 2 0 2 3 QUESTION 2 ( a ) Consider options on a non - dividend paying stock where the current share price and

Year

QUESTION

a Consider options on a nondividend paying stock where the current share price

and the option exercise price are both The share price is assumed to either

increase or decrease by each period of six months and the riskfree interest

rate is per annum.

Requirement

i Construct a riskfree portfolio for the first period for a call option.

Marks

ii Use a twoperiod binomial model to estimate the value of a one year European

call option

Marks

iii Use a twoperiod binomial model to estimate the value of a one year European

put option

Marks

b Explain the concept of putcall parity in the context of your answer to ii and iii

of part a

Marks

c Identify and discuss three potential uses of the putcall parity relationship.

Marks

I have attached the solutions, please provide a step by step method to achieve the solutions seen attached, thanks.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock