Question: You are constructing a strangle combination with European call and put options for a non- dividend paying stock, where the following information is given: current

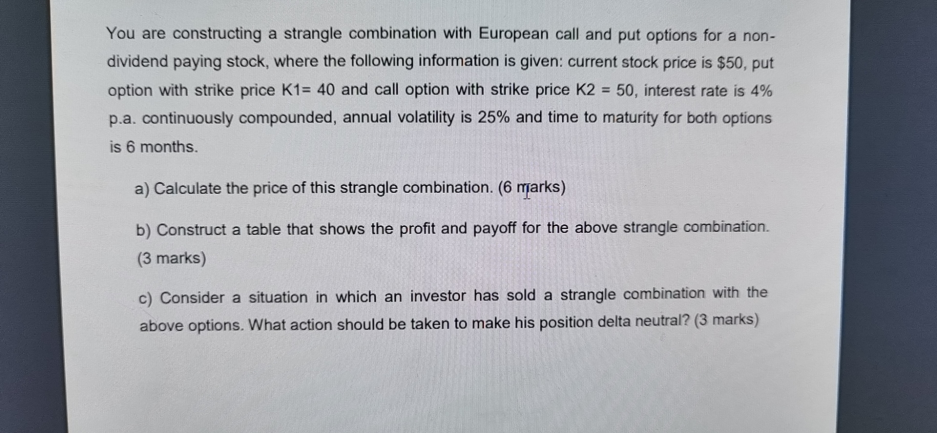

You are constructing a strangle combination with European call and put options for a non- dividend paying stock, where the following information is given: current stock price is $50, put option with strike price K1= 40 and call option with strike price K2 = 50, interest rate is 4% p.a. continuously compounded, annual volatility is 25% and time to maturity for both options is 6 months. a) Calculate the price of this strangle combination. (6 marks) b) Construct a table that shows the profit and payoff for the above strangle combination. (3 marks) c) Consider a situation in which an investor has sold a strangle combination with the above options. What action should be taken to make his position delta neutral? (3 marks) You are constructing a strangle combination with European call and put options for a non- dividend paying stock, where the following information is given: current stock price is $50, put option with strike price K1= 40 and call option with strike price K2 = 50, interest rate is 4% p.a. continuously compounded, annual volatility is 25% and time to maturity for both options is 6 months. a) Calculate the price of this strangle combination. (6 marks) b) Construct a table that shows the profit and payoff for the above strangle combination. (3 marks) c) Consider a situation in which an investor has sold a strangle combination with the above options. What action should be taken to make his position delta neutral

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts