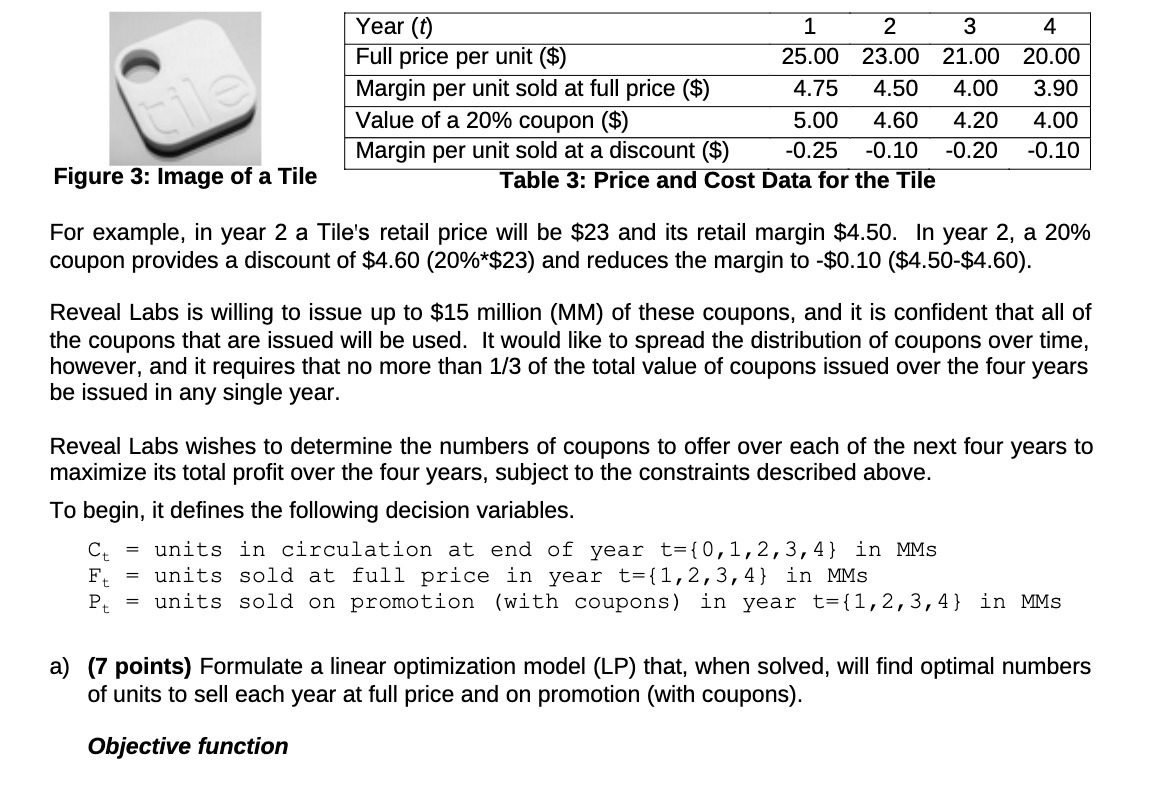

Question: Year (I) 1 2 3 4 Full price per unit ($) 25.00 23.00 21.00 20.00 i Margin per unit sold at full price ($) 4.75

Year (I) 1 2 3 4 Full price per unit ($) 25.00 23.00 21.00 20.00 i Margin per unit sold at full price ($) 4.75 4.50 4.00 3.90 Value of a 20% coupon ($) 5.00 4.60 4.20 4.00 _....._ _ Margin per unit sold at a discount ($) -0.25 -0.10 -0.20 -O.10 Figure 3: Image Of 3 Tile Table 3: Price and Cost Data for the Tile For example. in year 2 a Tile's retail price will be $23 and its retail margin $4.50. In year 2. a 20% coupon provides a discount of $4.60 (20%*$23) and reduces the margin to -$0.10 ($450-$460). Reveal Labs is willing to issue up to $15 million (MM) of these coupons. and it is confident that all of the coupons that are issued will be used. It would like to spread the distribution of coupons over time, however, and it requires that no more than 1I3 of the total value of coupons issued over the four years be issued in any single year. Reveal Labs wishes to determine the numbers of coupons to offer over each of the next four years to maximize its total prot over the four years, subject to the constraints described above. To begin. it denes the following decision variables. Ct = units in circulation at end of year t={0,l,2,3,4} in Ms Ft = units sold at full price in year t={l,2,3,4} in Ms Pt = units sold on promotion {with coupons) in year t={1,2.3,4} in MMs a) (7 points) Formulate a linear optimization model (LP) that. when solved. will find optimal numbers of units to sell each year at full price and on promotion (with coupons). Objective function

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts