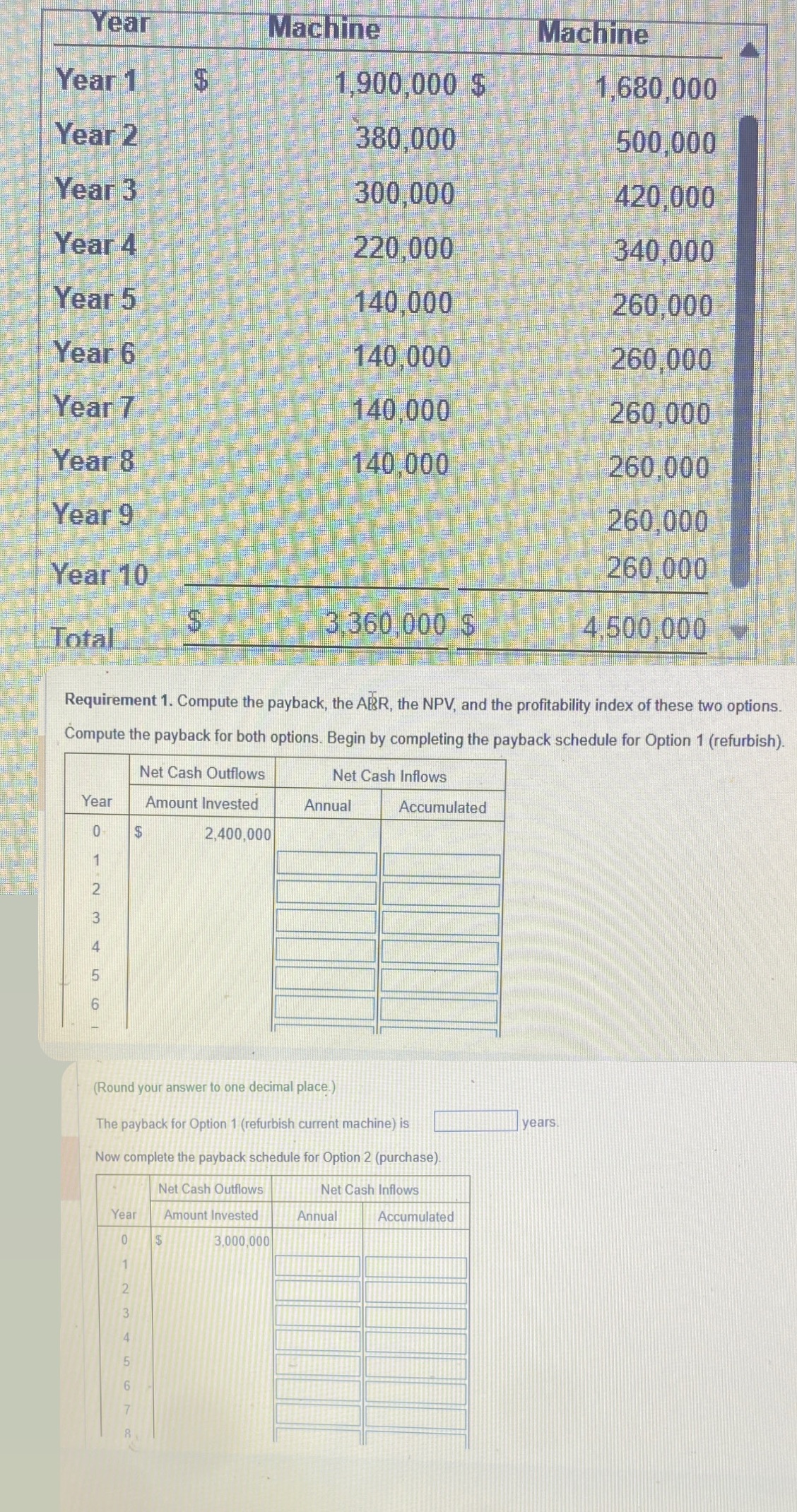

Question: Year Machine Machine Year 1 1,900,000 $ 1,680,000 Year 2 380,000 500,000 Year 3 300,000 420,000 Year 4 220,000 340.000 Year 5 140.000 260,000 Year

Year Machine Machine Year 1 1,900,000 $ 1,680,000 Year 2 380,000 500,000 Year 3 300,000 420,000 Year 4 220,000 340.000 Year 5 140.000 260,000 Year 6 140.000 260.000 Year 7 140,000 260,000 Year 8 140.000 260.000 Year 9 260,000 Year 10 260,000 $ 3.360.000 5 Total 4.500,000 Requirement 1. Compute the payback, the ABR, the NPV, and the profitability index of these two options. Compute the payback for both options. Begin by completing the payback schedule for Option 1 (refurbish). Net Cash Outflows Net Cash Inflows Year Amount Invested Annual Accumulated 0 $ 2,400,000 WN A (Round your answer to one decimal place.) The payback for Option 1 (refurbish current machine) is years. Now complete the payback schedule for Option 2 (purchase) Net Cash Outflows Net Cash Inflows Year Amount Invested Annual Accumulated 0 3,000,000 N - VOUAW 50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts