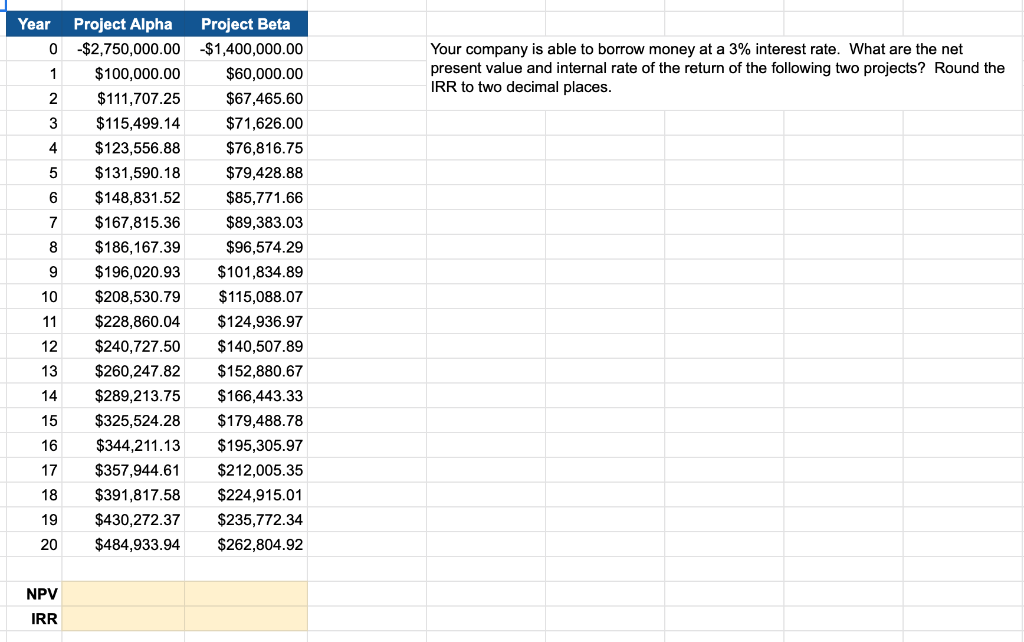

Question: Year Project Alpha Project Beta 0 -$2,750,000.00 -$1,400,000.00 1 $100,000.00 $60,000.00 2 $111,707.25 $67,465.60 3 $115,499.14 $71,626.00 4 $123,556.88 $76,816.75 5 $131,590.18 $79,428.88 6 $148,831.52

| Year | Project Alpha | Project Beta |

| 0 | -$2,750,000.00 | -$1,400,000.00 |

| 1 | $100,000.00 | $60,000.00 |

| 2 | $111,707.25 | $67,465.60 |

| 3 | $115,499.14 | $71,626.00 |

| 4 | $123,556.88 | $76,816.75 |

| 5 | $131,590.18 | $79,428.88 |

| 6 | $148,831.52 | $85,771.66 |

| 7 | $167,815.36 | $89,383.03 |

| 8 | $186,167.39 | $96,574.29 |

| 9 | $196,020.93 | $101,834.89 |

| 10 | $208,530.79 | $115,088.07 |

| 11 | $228,860.04 | $124,936.97 |

| 12 | $240,727.50 | $140,507.89 |

| 13 | $260,247.82 | $152,880.67 |

| 14 | $289,213.75 | $166,443.33 |

| 15 | $325,524.28 | $179,488.78 |

| 16 | $344,211.13 | $195,305.97 |

| 17 | $357,944.61 | $212,005.35 |

| 18 | $391,817.58 | $224,915.01 |

| 19 | $430,272.37 | $235,772.34 |

| 20 | $484,933.94 | $262,804.92 |

| NPV | ||

| IRR |

Year 0 Your company is able to borrow money at a 3% interest rate. What are the net present value and internal rate of the return of the following two projects? Round the IRR to two decimal places. Project Alpha $2,750,000.00 $100,000.00 $111,707.25 $115,499.14 $123,556.88 $131,590.18 $148,831.52 $167,815.36 $186,167.39 $196,020.93 $208,530.79 $228,860.04 $240,727.50 $260,247.82 $289,213.75 $325,524.28 $344,211.13 $357,944.61 $391,817.58 $430,272.37 $484,933.94 Project Beta $1,400,000.00 $60,000.00 $67,465.60 $71,626.00 $76,816.75 $79,428.88 $85,771.66 $89,383.03 $96,574.29 $101,834.89 $115,088.07 $124,936.97 $140,507.89 $152,880.67 $166,443.33 $179,488.78 $195,305.97 $212,005.35 $224,915.01 $235,772.34 $262,804.92 20 NPV IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts