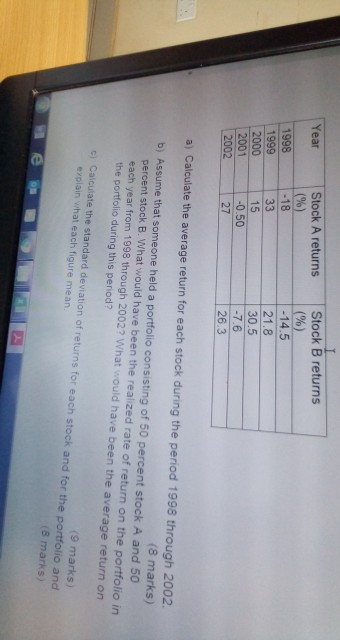

Question: Year Stock A returns (%) -18 33 1998 1999 2000 2001 2002 Stock B returns (%) -14.5 21.8 30.5 -7.6 26.3 15 -0.50 a) Calculate

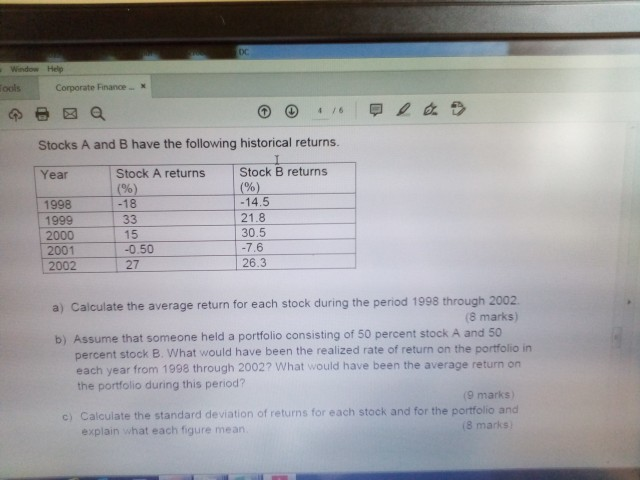

Year Stock A returns (%) -18 33 1998 1999 2000 2001 2002 Stock B returns (%) -14.5 21.8 30.5 -7.6 26.3 15 -0.50 a) Calculate the average return for each stock during the period 1998 through 2002. (8 marks) b) Assume that someone held a portfolio consisting of 50 percent stock A and 50 percent stock B. What would have been the realized rate of return on the portfolio in each year from 1998 through 2002? What would have been the average return on the portfolio during this period? Calculate the standard deviation of returns for each stock and for the portfolio and (9 marks) explain what each figure mean. 8 marks Window Hello Tools Corporate Finance Stocks A and B have the following historical returns. Year 1998 1999 2000 2001 2002 Stock A returns (96) -18 33 15 -0.50 27 Stock B returns (%) - 14.5 21.8 30.5 -7.6 26.3 a) Calculate the average return for each stock during the period 1998 through 2002 8 marks) b) Assume that someone held a portfolio consisting of 50 percent stock A and 50 percent stock B. What would have been the realized rate of return on the portfolio in each year from 1998 through 2002? What would have been the average return on the portfolio during this period? (9 marks c) Calculate the standard deviation of returns for each stock and for the portfolio and explain what each figure mean (8 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts