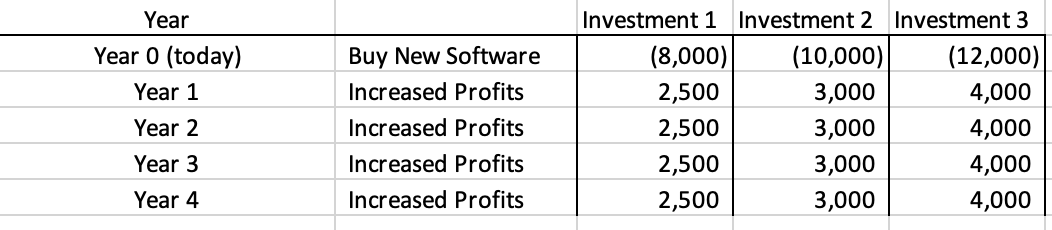

Question: Year Year 0 (today) Year 1 Year 2 Year 3 Year 4 Buy New Software Increased Profits Increased Profits Increased Profits Increased Profits Investment

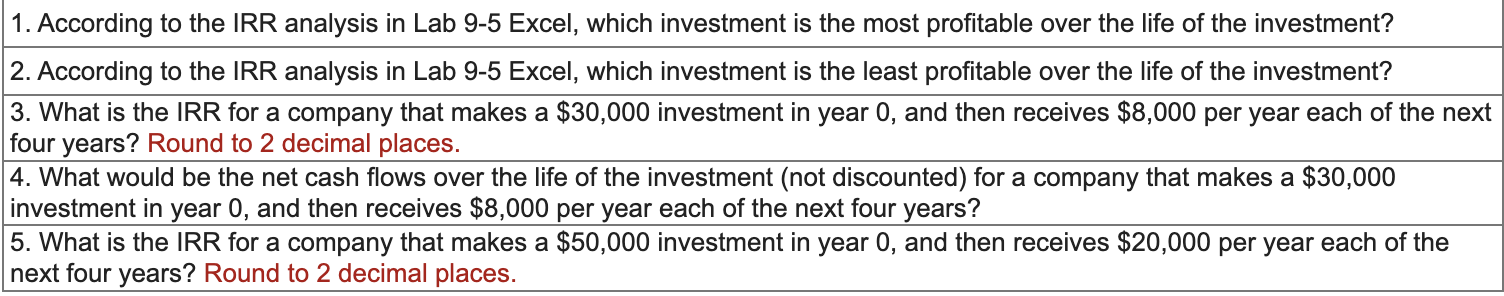

Year Year 0 (today) Year 1 Year 2 Year 3 Year 4 Buy New Software Increased Profits Increased Profits Increased Profits Increased Profits Investment 1 Investment 2 Investment 3 (8,000) (10,000) 2,500 3,000 2,500 3,000 2,500 3,000 2,500 3,000 (12,000) 4,000 4,000 4,000 4,000 1. According to the IRR analysis in Lab 9-5 Excel, which investment is the most profitable over the life of the investment? 2. According to the IRR analysis in Lab 9-5 Excel, which investment is the least profitable over the life of the investment? 3. What is the IRR for a company that makes a $30,000 investment in year 0, and then receives $8,000 per year each of the next four years? Round to 2 decimal places. 4. What would be the net cash flows over the life of the investment (not discounted) for a company that makes a $30,000 investment in year 0, and then receives $8,000 per year each of the next four years? 5. What is the IRR for a company that makes a $50,000 investment in year 0, and then receives $20,000 per year each of the next four years? Round to 2 decimal places.

Step by Step Solution

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Here are the stepbystep calculations for each question 1 According to the information provided Inves... View full answer

Get step-by-step solutions from verified subject matter experts