Question: 1. According to the NPV analysis, which investment is least profitable over the life of the investment? 2. What would be the NPV for

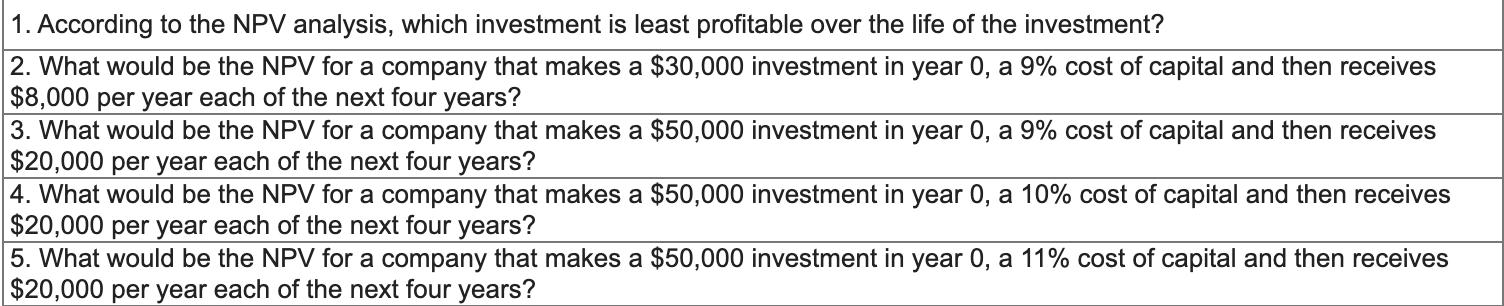

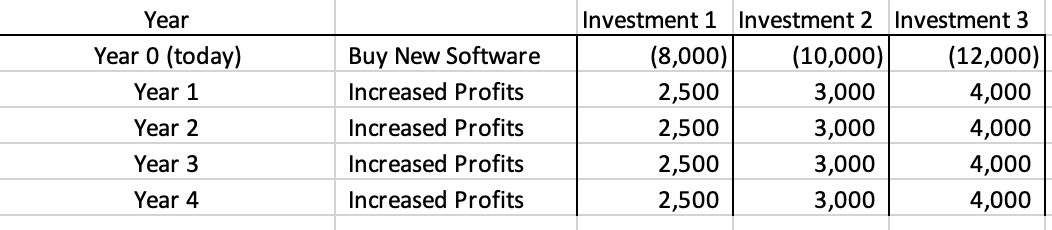

1. According to the NPV analysis, which investment is least profitable over the life of the investment? 2. What would be the NPV for a company that makes a $30,000 investment in year 0, a 9% cost of capital and then receives $8,000 per year each of the next four years? 3. What would be the NPV for a company that makes a $50,000 investment in year 0, a 9% cost of capital and then receives $20,000 per year each of the next four years? 4. What would be the NPV for a company that makes a $50,000 investment in year 0, a 10% cost of capital and then receives $20,000 per year each of the next four years? 5. What would be the NPV for a company that makes a $50,000 investment in year 0, a 11% cost of capital and then receives $20,000 per year each of the next four years? Year Year 0 (today) Year 1 Year 2 Year 3 Year 4 Buy New Software Increased Profits Increased Profits Increased Profits Increased Profits Investment 1 Investment 2 Investment 3 (8,000) (10,000) 2,500 3,000 2,500 3,000 2,500 3,000 2,500 3,000 (12,000) 4,000 4,000 4,000 4,000

Step by Step Solution

3.37 Rating (150 Votes )

There are 3 Steps involved in it

1 Based on the information given Investment 1 has the least profitable NPV over the life of the inve... View full answer

Get step-by-step solutions from verified subject matter experts