Question: years. The Topic: Effective Annual Cost 10) Machine A costs $10,000 at t = 0 and needs to be replaced every 10 price of Machine

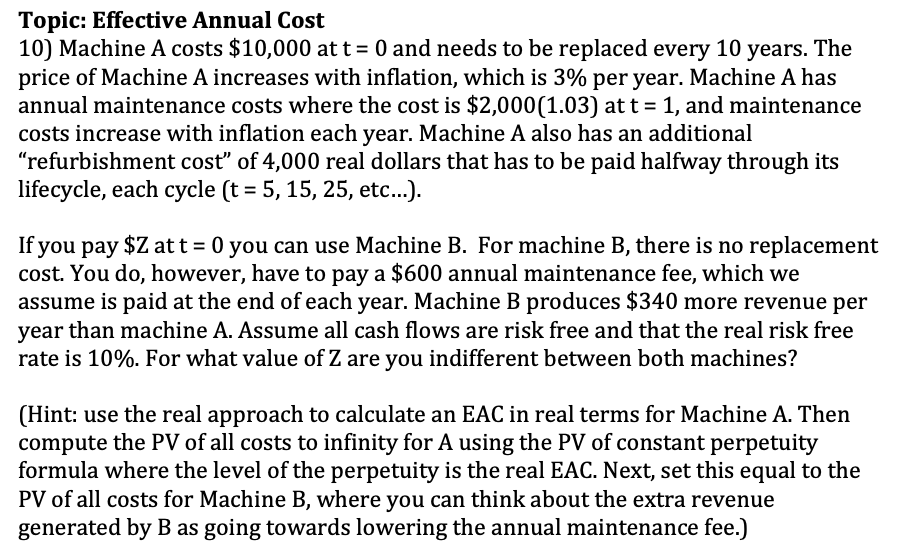

years. The Topic: Effective Annual Cost 10) Machine A costs $10,000 at t = 0 and needs to be replaced every 10 price of Machine A increases with inflation, which is 3% per year. Machine A has annual maintenance costs where the cost is $2,000(1.03) at t = 1, and maintenance costs increase with inflation each year. Machine A also has an additional refurbishment cos" of 4,000 real dollars that has to be paid halfway through its lifecycle, each cycle (t = 5, 15, 25, etc...). If you pay $Z at t = 0 you can use Machine B. For machine B, there is no replacement cost. You do, however, have to pay a $600 annual maintenance fee, which we assume is paid at the end of each year. Machine B produces $340 more revenue per year than machine A. Assume all cash flows are risk free and that the real risk free rate is 10%. For what value of Z are you indifferent between both machines? (Hint: use the real approach to calculate an EAC in real terms for Machine A. Then compute the PV of all costs to infinity for A using the PV of constant perpetuity formula where the level of the perpetuity is the real EAC. Next, set this equal to the PV of all costs for Machine B, where you can think about the extra revenue generated by B as going towards lowering the annual maintenance fee.) years. The Topic: Effective Annual Cost 10) Machine A costs $10,000 at t = 0 and needs to be replaced every 10 price of Machine A increases with inflation, which is 3% per year. Machine A has annual maintenance costs where the cost is $2,000(1.03) at t = 1, and maintenance costs increase with inflation each year. Machine A also has an additional refurbishment cos" of 4,000 real dollars that has to be paid halfway through its lifecycle, each cycle (t = 5, 15, 25, etc...). If you pay $Z at t = 0 you can use Machine B. For machine B, there is no replacement cost. You do, however, have to pay a $600 annual maintenance fee, which we assume is paid at the end of each year. Machine B produces $340 more revenue per year than machine A. Assume all cash flows are risk free and that the real risk free rate is 10%. For what value of Z are you indifferent between both machines? (Hint: use the real approach to calculate an EAC in real terms for Machine A. Then compute the PV of all costs to infinity for A using the PV of constant perpetuity formula where the level of the perpetuity is the real EAC. Next, set this equal to the PV of all costs for Machine B, where you can think about the extra revenue generated by B as going towards lowering the annual maintenance fee.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts