Question: Yellow Hammer Fund has both class A and class B shares. Class A shares are offered with a 3% front-end load with no 12b-1

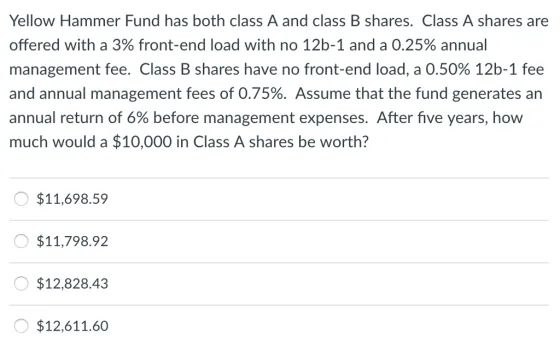

Yellow Hammer Fund has both class A and class B shares. Class A shares are offered with a 3% front-end load with no 12b-1 and a 0.25% annual management fee. Class B shares have no front-end load, a 0.50% 12b-1 fee and annual management fees of 0.75%. Assume that the fund generates an annual return of 6% before management expenses. After five years, how much would a $10,000 in Class A shares be worth? $11,698.59 $11,798.92 $12,828.43 $12,611.60

Step by Step Solution

3.47 Rating (154 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provided below To calculate the value of the investmen... View full answer

Get step-by-step solutions from verified subject matter experts