Question: Yo QUESTION 17 O points Save Answer A $1,000 face value corporate bond is purchased at the market price of $850 on January 1, 2021.

Yo

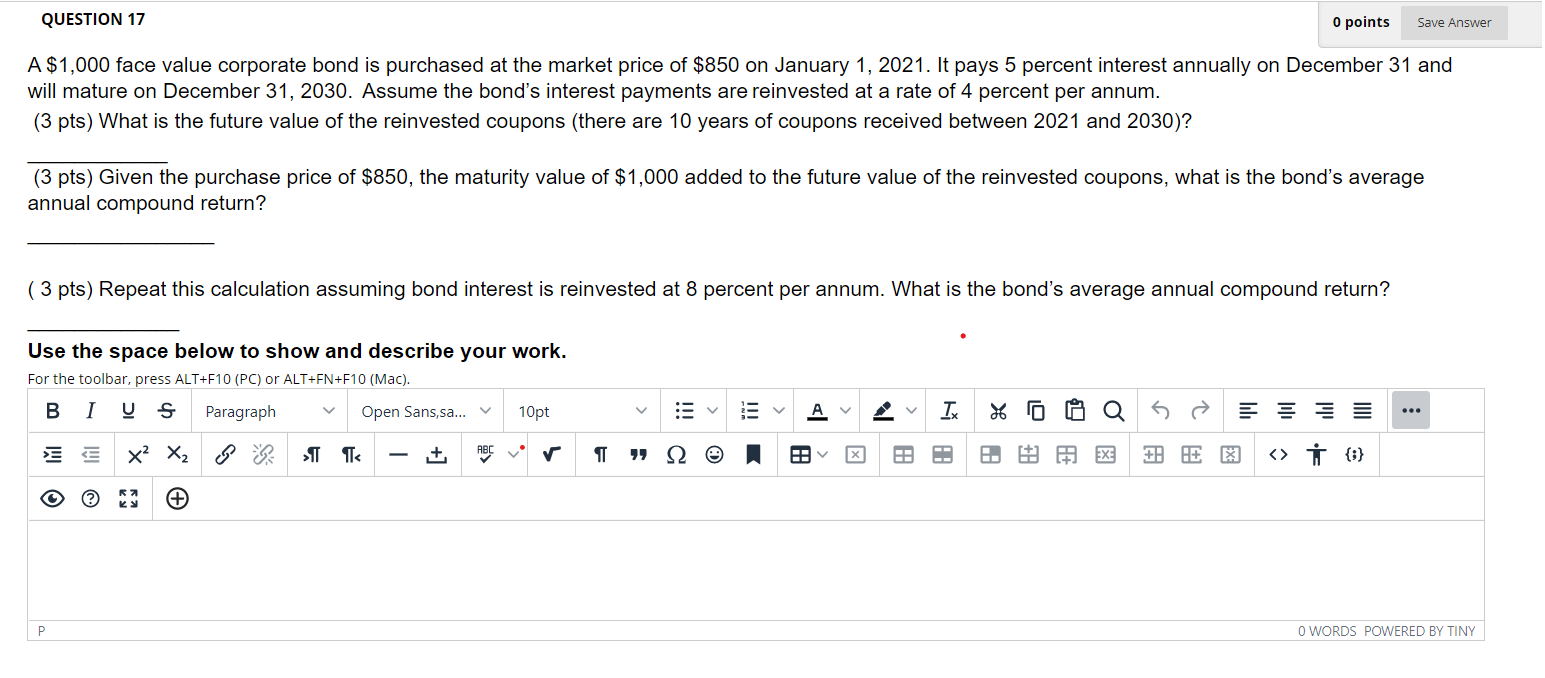

QUESTION 17 O points Save Answer A $1,000 face value corporate bond is purchased at the market price of $850 on January 1, 2021. It pays 5 percent interest annually on December 31 and will mature on December 31, 2030. Assume the bond's interest payments are reinvested at a rate of 4 percent per annum. (3 pts) What is the future value of the reinvested coupons (there are 10 years of coupons received between 2021 and 2030)? (3 pts) Given the purchase price of $850, the maturity value of $1,000 added to the future value of the reinvested coupons, what is the bond's average annual compound return? (3 pts) Repeat this calculation assuming bond interest is reinvested at 8 percent per annum. What is the bond's average annual compound return? Use the space below to show and describe your work. For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). B I U Paragraph Open Sans,sa... 10pt v TX % od a Y E X2 X2 st llc + ABC v T 22 Av. X A H EX: {:} # O WORDS POWERED BY TINY

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts