Question: You and Sally agreed to develop a negotiation plan, mapping out a strategy to purchase the Boca Raton property to establish the restaurant. After reviewing

You and Sally agreed to develop a negotiation plan, mapping out a strategy to purchase the Boca Raton property to establish the restaurant. After reviewing the market plan and the terms of the proposed agreement, you suggest to Sally that it would be great if the two of you could map out the areas you believe could be negotiated with the owner. The plan would provide you with a prioritized list of issues to facilitate an agreement with the owner. Sally tells you that she has a perfect tool for plan development. Sally has emailed you a copy of the mapping tools and asks if you would take a shot at filling it out. Compare your term sheet information and the owner's positions listed in the Marketing Study for the property in Boca Raton (PDF). Download Marketing Study for the property in Boca Raton (PDF). In the negotiation matrix, map out the issues that you and the owner expressed in the marketing study.

You told Sally that you were going for a win-win in the negotiations. She recommended that you review the article below to learn the language needed to make winning arguments.

Review the marketing information and the seller's position concerning the property and priorities.

Complete and upload the Term Sheet (DOCX) Download Term Sheet (DOCX)answering the issues presented and include your principle objectives in the forms.

Read the Contract Negotiation Process (PDF).Download Contract Negotiation Process (PDF).

Review this video:

Orange Example/Negotiation by Design (YouTube/7:46)Links to an external site.

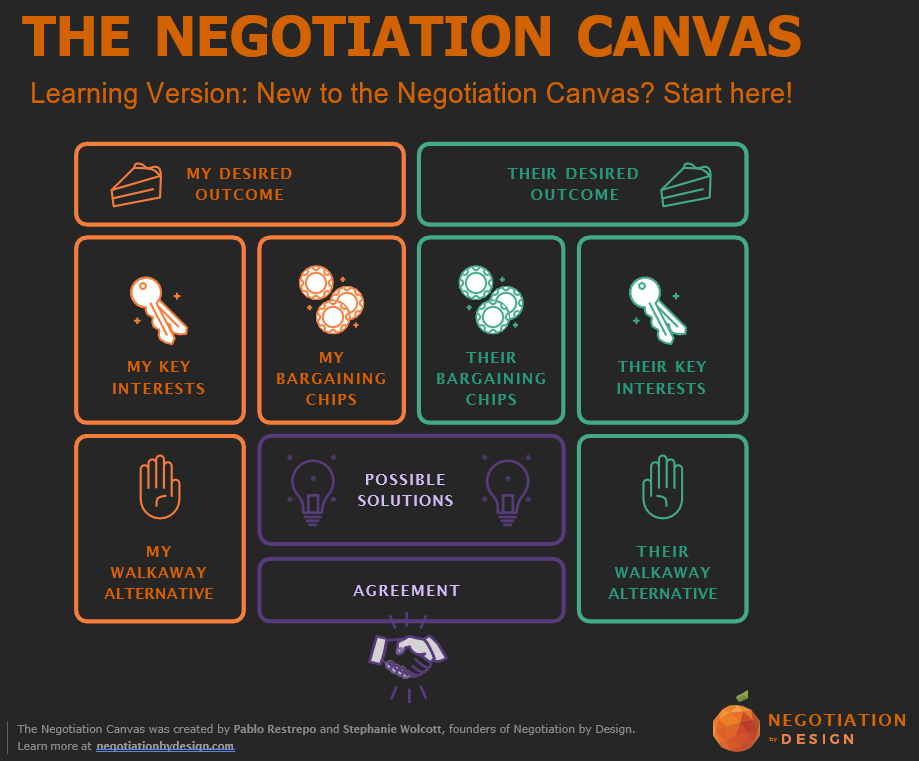

To establish your and Sally's positions, make appropriate assumptions to complete the Learning Canvas Matrix (DOCX). Download Learning Canvas Matrix (DOCX).The information you used to complete your term sheet contains the significant issues in your matrix. Short non-descriptive responses will not be graded. Assume the matrix will be shared with other individuals assisting you in the negotiation. Therefore, your information must include both the term sheet issues and responses. The matrix must be descriptive enough that others can comprehend your negotiation points listed in each matrix box. When establishing responses to the matrix questions, write them clearly and sufficiently to allow a third party to understand your perspective of the negotiations.

Caution: Since the matrix is a planning tool, please note that "yes" or "no" answers, personal keywords without explanation, one-sentence or incomplete sentences are not acceptable as a response. Solutions should be fully developed and analyzed. The entries into the matrix must demonstrate negotiable items that are more than your personal opinion. Entries must contain achievable or negotiable issues based on the facts of the entire case study. Entries are required to be single-spaced, with no white space or empty boxes.

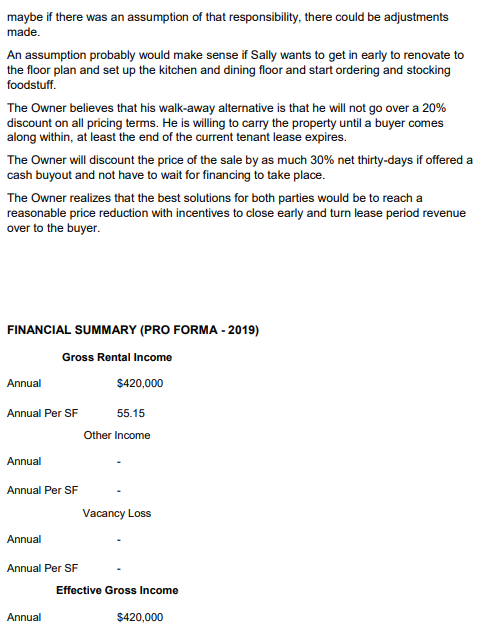

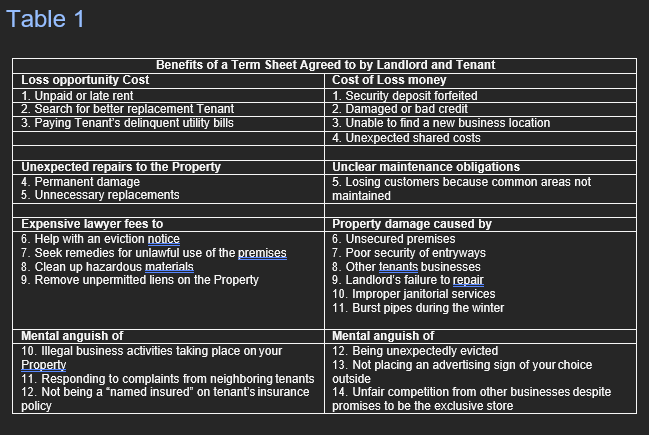

Term Sheet:

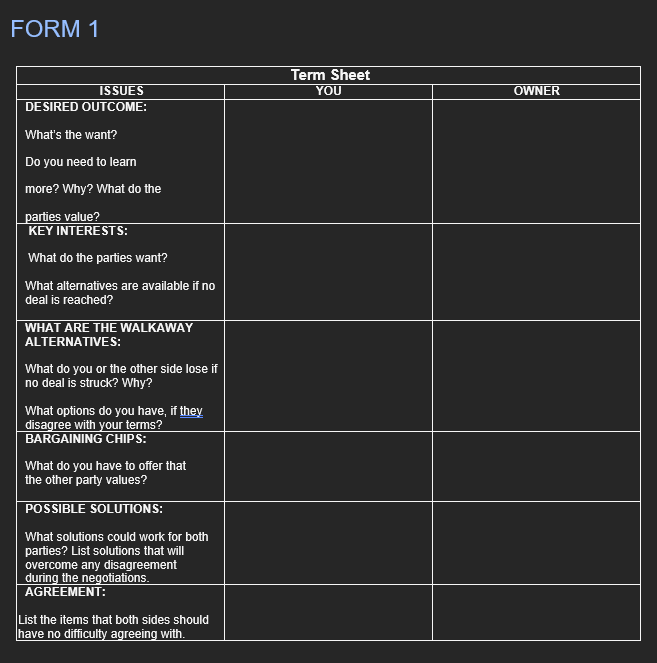

The Learning Canvas Matrix

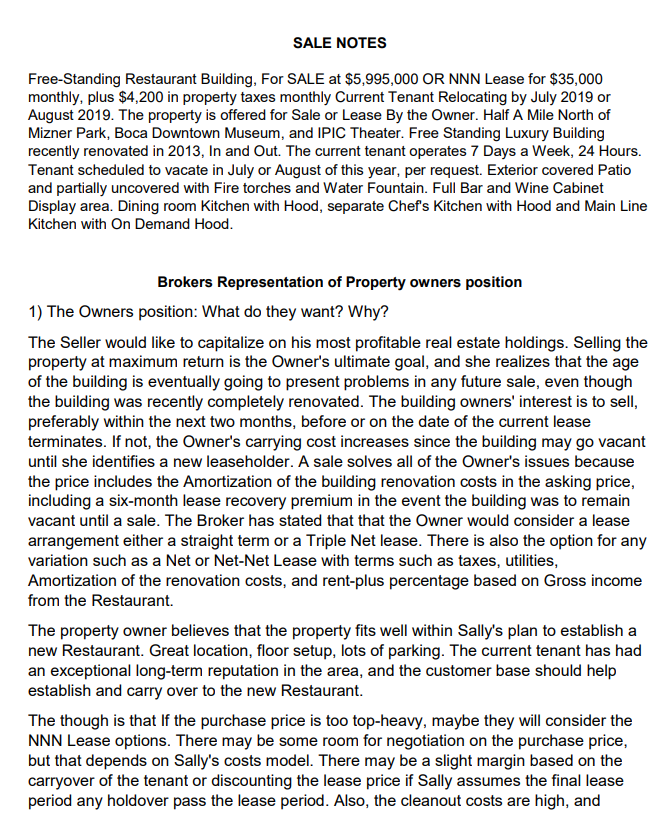

SALE NOTES Free-Standing Restaurant Building, For SALE at $5,995,000 OR NNN Lease for $35,000 monthly, plus $4,200 in property taxes monthly Current Tenant Relocating by July 2019 or August 2019. The property is offered for Sale or Lease By the Owner. Half A Mile North of Mizner Park, Boca Downtown Museum, and IPIC Theater. Free Standing Luxury Building recently renovated in 2013, In and Out. The current tenant operates 7 Days a Week, 24 Hours. Tenant scheduled to vacate in July or August of this year, per request. Exterior covered Patio and partially uncovered with Fire torches and Water Fountain. Full Bar and Wine Cabinet Display area. Dining room Kitchen with Hood, separate Chef's Kitchen with Hood and Main Line Kitchen with On Demand Hood. Brokers Representation of Property owners position 1) The Owners position: What do they want? Why? The Seller would like to capitalize on his most profitable real estate holdings. Selling the property at maximum return is the Owner's ultimate goal, and she realizes that the age of the building is eventually going to present problems in any future sale, even though the building was recently completely renovated. The building owners' interest is to sell, preferably within the next two months, before or on the date of the current lease terminates. If not, the Owner's carrying cost increases since the building may go vacant until she identifies a new leaseholder. A sale solves all of the Owner's issues because the price includes the Amortization of the building renovation costs in the asking price, including a six-month lease recovery premium in the event the building was to remain vacant until a sale. The Broker has stated that that the Owner would consider a lease arrangement either a straight term or a Triple Net lease. There is also the option for any variation such as a Net or Net-Net Lease with terms such as taxes, utilities, Amortization of the renovation costs, and rent-plus percentage based on Gross income from the Restaurant. The property owner believes that the property fits well within Sally's plan to establish a new Restaurant. Great location, floor setup, lots of parking. The current tenant has had an exceptional long-term reputation in the area, and the customer base should help establish and carry over to the new Restaurant. The though is that If the purchase price is too top-heavy, maybe they will consider the NNN Lease options. There may be some room for negotiation on the purchase price, but that depends on Sally's costs model. There may be a slight margin based on the carryover of the tenant or discounting the lease price if Sally assumes the final lease period any holdover pass the lease period. Also, the cleanout costs are high, and maybe if there was an assumption of that responsibility, there could be adjustments made. An assumption probably would make sense if Sally wants to get in early to renovate to the floor plan and set up the kitchen and dining floor and start ordering and stocking foodstuff. The Owner believes that his walk-away alternative is that he will not go over a 20% discount on all pricing terms. He is willing to carry the property until a buyer comes along within, at least the end of the current tenant lease expires. The Owner will discount the price of the sale by as much 30% net thirty-days if offered a cash buyout and not have to wait for financing to take place. The Owner realizes that the best solutions for both parties would be to reach a reasonable price reduction with incentives to close early and turn lease period revenue over to the buyer. FINANCIAL SUMMARY (PRO FORMA - 2019) FORM 1 FORM 2 Table 1 THE NEGOTIATION CANVAS SALE NOTES Free-Standing Restaurant Building, For SALE at $5,995,000 OR NNN Lease for $35,000 monthly, plus $4,200 in property taxes monthly Current Tenant Relocating by July 2019 or August 2019. The property is offered for Sale or Lease By the Owner. Half A Mile North of Mizner Park, Boca Downtown Museum, and IPIC Theater. Free Standing Luxury Building recently renovated in 2013, In and Out. The current tenant operates 7 Days a Week, 24 Hours. Tenant scheduled to vacate in July or August of this year, per request. Exterior covered Patio and partially uncovered with Fire torches and Water Fountain. Full Bar and Wine Cabinet Display area. Dining room Kitchen with Hood, separate Chef's Kitchen with Hood and Main Line Kitchen with On Demand Hood. Brokers Representation of Property owners position 1) The Owners position: What do they want? Why? The Seller would like to capitalize on his most profitable real estate holdings. Selling the property at maximum return is the Owner's ultimate goal, and she realizes that the age of the building is eventually going to present problems in any future sale, even though the building was recently completely renovated. The building owners' interest is to sell, preferably within the next two months, before or on the date of the current lease terminates. If not, the Owner's carrying cost increases since the building may go vacant until she identifies a new leaseholder. A sale solves all of the Owner's issues because the price includes the Amortization of the building renovation costs in the asking price, including a six-month lease recovery premium in the event the building was to remain vacant until a sale. The Broker has stated that that the Owner would consider a lease arrangement either a straight term or a Triple Net lease. There is also the option for any variation such as a Net or Net-Net Lease with terms such as taxes, utilities, Amortization of the renovation costs, and rent-plus percentage based on Gross income from the Restaurant. The property owner believes that the property fits well within Sally's plan to establish a new Restaurant. Great location, floor setup, lots of parking. The current tenant has had an exceptional long-term reputation in the area, and the customer base should help establish and carry over to the new Restaurant. The though is that If the purchase price is too top-heavy, maybe they will consider the NNN Lease options. There may be some room for negotiation on the purchase price, but that depends on Sally's costs model. There may be a slight margin based on the carryover of the tenant or discounting the lease price if Sally assumes the final lease period any holdover pass the lease period. Also, the cleanout costs are high, and maybe if there was an assumption of that responsibility, there could be adjustments made. An assumption probably would make sense if Sally wants to get in early to renovate to the floor plan and set up the kitchen and dining floor and start ordering and stocking foodstuff. The Owner believes that his walk-away alternative is that he will not go over a 20% discount on all pricing terms. He is willing to carry the property until a buyer comes along within, at least the end of the current tenant lease expires. The Owner will discount the price of the sale by as much 30% net thirty-days if offered a cash buyout and not have to wait for financing to take place. The Owner realizes that the best solutions for both parties would be to reach a reasonable price reduction with incentives to close early and turn lease period revenue over to the buyer. FINANCIAL SUMMARY (PRO FORMA - 2019) FORM 1 FORM 2 Table 1 THE NEGOTIATION CANVAS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts