Question: You and your partner decide that it is time for you to move in together, so you start looking at houses. You find a

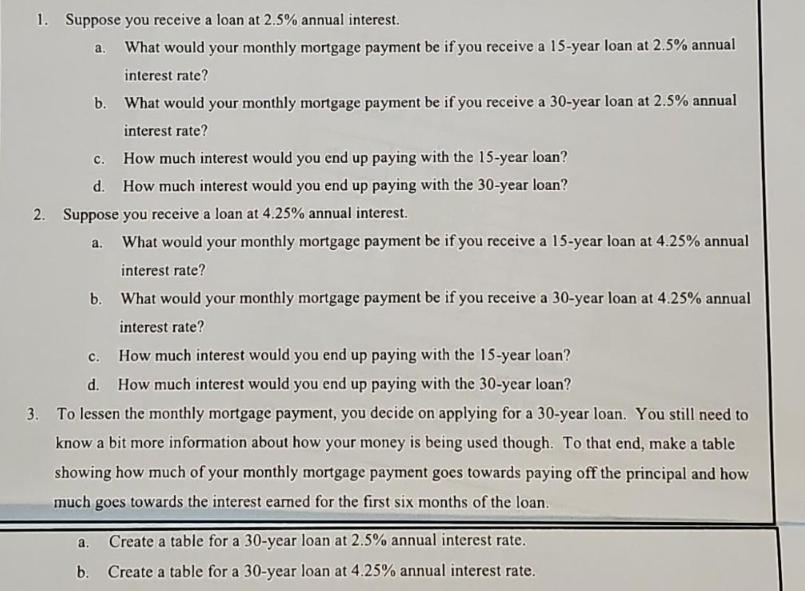

You and your partner decide that it is time for you to move in together, so you start looking at houses. You find a house you both love for $328,000. Before you speak with your bank you want to get an idea of what your monthly mortgage payment is going to be. You look up the current fixed interest rates for first time homeowners and it appears that rates vary from 2.5% and 4.25%. You also did a bit of research, and you know that for a mortgage earning R% annual interest over / years, the monthly mortgage payment is given by the formula M = TP 1- (1 + r)-12t R where r = and P is the principal. 12 Use this formula to answer the following questions. Round all answers to two decimal places. 1. Suppose you receive a loan at 2.5% annual interest. a. What would your monthly mortgage payment be if you receive a 15-year loan at 2.5% annual interest rate? b. What would your monthly mortgage payment be if you receive a 30-year loan at 2.5% annual interest rate? c. How much interest would you end up paying with the 15-year loan? d. How much interest would you end up paying with the 30-year loan? 2. Suppose you receive a loan at 4.25% annual interest. a. What would your monthly mortgage payment be if you receive a 15-year loan at 4.25% annual interest rate? b. What would your monthly mortgage payment be if you receive a 30-year loan at 4.25% annual interest rate? c. How much interest would you end up paying with the 15-year loan? d. How much interest would you end up paying with the 30-year loan? 3. To lessen the monthly mortgage payment, you decide on applying for a 30-year loan. You still need to know a bit more information about how your money is being used though. To that end, make a table showing how much of your monthly mortgage payment goes towards paying off the principal and how much goes towards the interest earned for the first six months of the loan. a. Create a table for a 30-year loan at 2.5% annual interest rate. b. Create a table for a 30-year loan at 4.25% annual interest rate.

Step by Step Solution

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Question 1 a For a 15year loan at 25 annual interest rate r 2512 020833 monthly interest rate t 15 loan duration in years Plugging in the values in the given formula M P r 1 1 r12t M P 020833 1 1 0208... View full answer

Get step-by-step solutions from verified subject matter experts