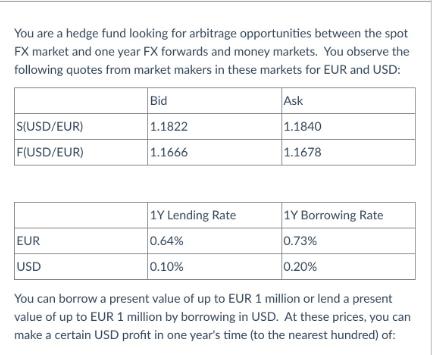

Question: You are a hedge fund looking for arbitrage opportunities between the spot FX market and one year FX forwards and money markets. You observe

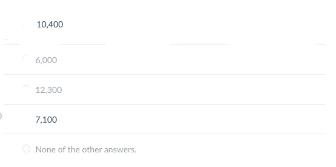

You are a hedge fund looking for arbitrage opportunities between the spot FX market and one year FX forwards and money markets. You observe the following quotes from market makers in these markets for EUR and USD: S(USD/EUR) F(USD/EUR) EUR USD Bid 1.1822 1.1666 1Y Lending Rate 0.64% 0.10% Ask 1.1840 1.1678 1Y Borrowing Rate 0.73% 0.20% You can borrow a present value of up to EUR 1 million or lend a present value of up to EUR 1 million by borrowing in USD. At these prices, you can make a certain USD profit in one year's time (to the nearest hundred) of: 10,400 6,000 12,300 7.100 None of the other answers,

Step by Step Solution

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Answer To calculate the profit we need to first determine the forward points spread between the spot rate and the forward rate The forward points spread is calculated as follows Forward Points Spread ... View full answer

Get step-by-step solutions from verified subject matter experts