Question: You are a junior analyst that is tasked with assessing the performance of a portfolio (Portfolio A). You know that returns are impacted by the

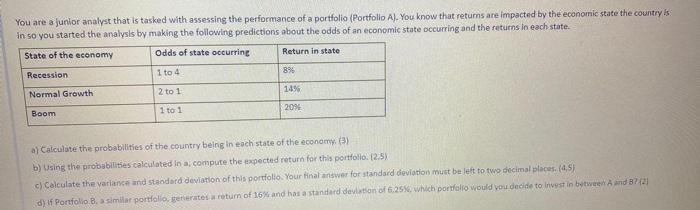

You are a junior analyst that is tasked with assessing the performance of a portfolio (Portfolio A). You know that returns are impacted by the economic state the country is in so you started the analysis by making the following predictions about the odds of an economic state occurring and the returns in each state. State of the economy Odds of state occurring Return in state Recession 1 to 4 896 14% Normal Growth 2 to 1 Boom 1 to 1 209 a) Calculate the probabilities of the country being in each state of the economy. (3) b) Using the probabilities calculated in a compute the expected return for this portfolio. 12,5) c) Calculate the variance and standard deviation of this portfolio. Your final answer for standard deviation must be left to two decimal places. (4.57 d) If Portfolio B. a similar portfolio generates a return of 16% and has a standard deviation of 6.25%, which portfolio would you decide to invest in byter and 8721

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts