Question: You are also proposing a second project with variable costs and returns. Assume that the project is expected to return monetary benefits of $50,000 the

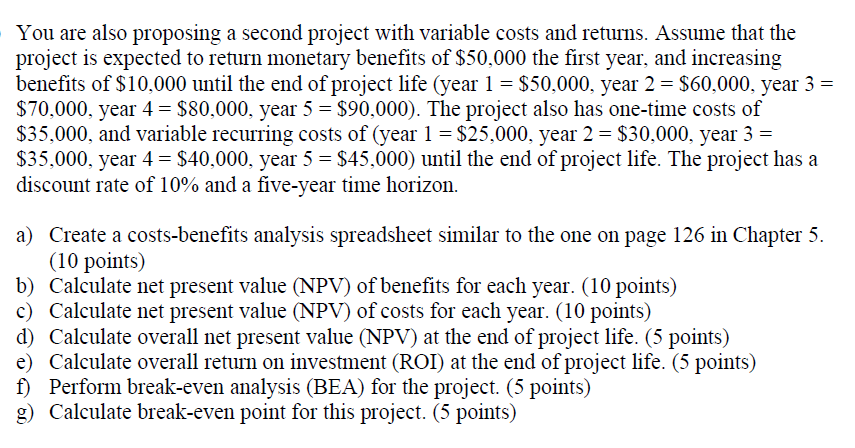

You are also proposing a second project with variable costs and returns. Assume that the project is expected to return monetary benefits of $50,000 the first year, and increasing benefits of $10,000 until the end of project life (year 1=$50,000, year 2=$60,000, year 3= $70,000, year 4=$80,000, year 5=$90,000). The project also has one-time costs of $35,000, and variable recurring costs of (year 1=$25,000, year 2=$30,000, year 3= $35,000, year 4=$40,000, year 5=$45,000) until the end of project life. The project has a discount rate of 10% and a five-year time horizon. a) Create a costs-benefits analysis spreadsheet similar to the one on page 126 in Chapter 5 . (10 points) b) Calculate net present value (NPV) of benefits for each year. (10 points) c) Calculate net present value (NPV) of costs for each year. (10 points) d) Calculate overall net present value (NPV) at the end of project life. (5 points) e) Calculate overall return on investment (ROI) at the end of project life. (5 points) f) Perform break-even analysis (BEA) for the project. (5 points) g) Calculate break-even point for this project. (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts