Question: You are analyzing a stock trading at ( $ 5 0 ) with a volatility of ( 3 0 %

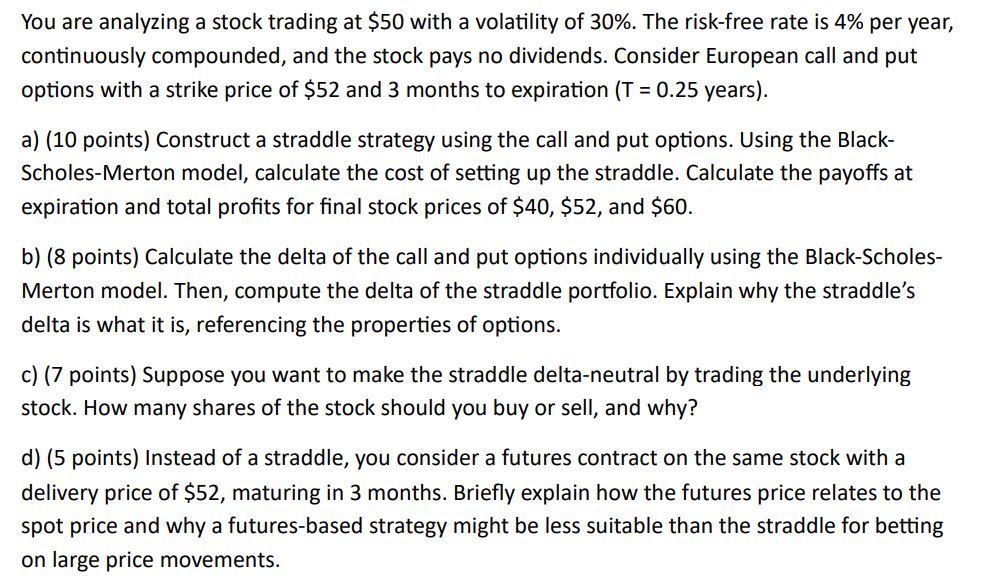

You are analyzing a stock trading at $ with a volatility of The riskfree rate is per year, continuously compounded, and the stock pays no dividends. Consider European call and put options with a strike price of $ and months to expiration T years a points Construct a straddle strategy using the call and put options. Using the BlackScholesMerton model, calculate the cost of setting up the straddle. Calculate the payoffs at expiration and total profits for final stock prices of $ $ and $ b points Calculate the delta of the call and put options individually using the BlackScholesMerton model. Then, compute the delta of the straddle portfolio. Explain why the straddle's delta is what it is referencing the properties of options. c points Suppose you want to make the straddle deltaneutral by trading the underlying stock. How many shares of the stock should you buy or sell, and why? d points Instead of a straddle, you consider a futures contract on the same stock with a delivery price of $ maturing in months. Briefly explain how the futures price relates to the spot price and why a futuresbased strategy might be less suitable than the straddle for betting on large price movements.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock