Question: You are asked to estimate the forward-looking 95% confidence interval of the CAPM expected annual return on Stock T during an interview with an investment

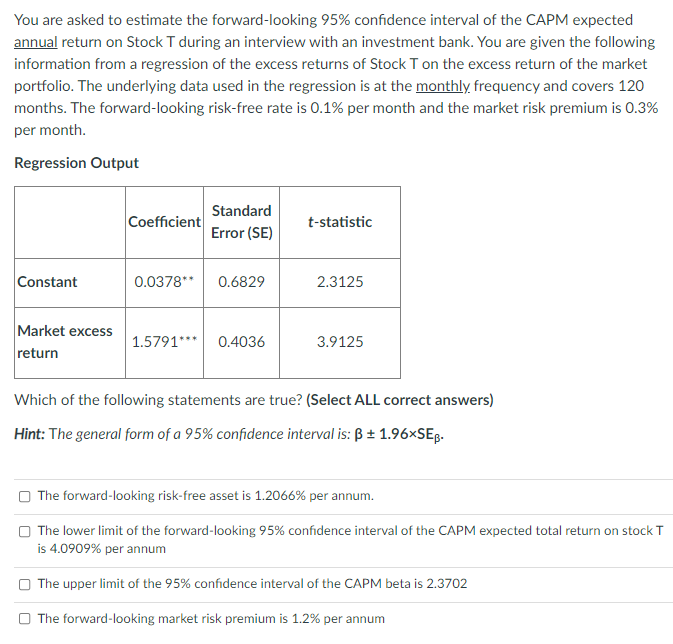

You are asked to estimate the forward-looking 95% confidence interval of the CAPM expected annual return on Stock T during an interview with an investment bank. You are given the following information from a regression of the excess returns of Stock T on the excess return of the market portfolio. The underlying data used in the regression is at the monthly frequency and covers 120 months. The forward-looking risk-free rate is 0.1% per month and the market risk premium is 0.3% per month. Regression Output Coefficient Standard Error (SE) t-statistic Constant 0.0378** 0.6829 2.3125 Market excess return 1.5791*** 0.4036 3.9125 Which of the following statements are true? (Select ALL correct answers) Hint: The general form of a 95% confidence interval is: B + 1.96xSEB- The forward-looking risk-free asset is 1.2066% per annum. The lower limit of the forward-looking 95% confidence interval of the CAPM expected total return on stock T is 4.0909% per annum The upper limit of the 95% confidence interval of the CAPM beta is 2.3702 The forward-looking market risk premium is 1.2% per annum

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts