Question: You are asked to evaluate a project for a client based on a sensitivity analysis using the following data with a life span of 7

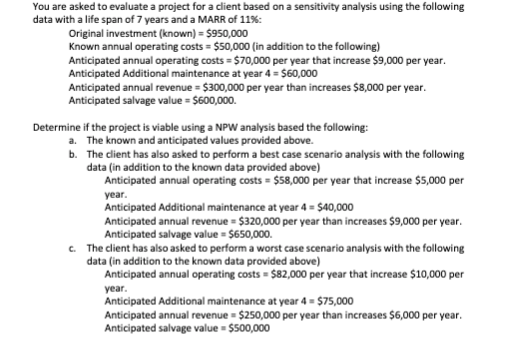

You are asked to evaluate a project for a client based on a sensitivity analysis using the following data with a life span of 7 years and a MARR of 11%: Original investment (known) = $950,000 Known annual operating costs = $50,000 in addition to the following) Anticipated annual operating costs = $70,000 per year that increase $9,000 per year. Anticipated Additional maintenance at year 4 = $60,000 Anticipated annual revenue - $300,000 per year than increases $8,000 per year. Anticipated salvage value = $600,000 Determine if the project is viable using a NPW analysis based the following: a. The known and anticipated values provided above. b. The client has also asked to perform a best case scenario analysis with the following data (in addition to the known data provided above) Anticipated annual operating costs = $58,000 per year that increase $5,000 per year. Anticipated Additional maintenance at year 4 = $40,000 Anticipated annual revenue = $320,000 per year than increases $9,000 per year. Anticipated salvage value = $650,000. The client has also asked to perform a worst case scenario analysis with the following data (in addition to the known data provided above) Anticipated annual operating costs = $82,000 per year that increase $10,000 per year. Anticipated Additional maintenance at year 4 = $75,000 Anticipated annual revenue = $250,000 per year than increases $6,000 per year. Anticipated salvage value = $500,000 You are asked to evaluate a project for a client based on a sensitivity analysis using the following data with a life span of 7 years and a MARR of 11%: Original investment (known) = $950,000 Known annual operating costs = $50,000 in addition to the following) Anticipated annual operating costs = $70,000 per year that increase $9,000 per year. Anticipated Additional maintenance at year 4 = $60,000 Anticipated annual revenue - $300,000 per year than increases $8,000 per year. Anticipated salvage value = $600,000 Determine if the project is viable using a NPW analysis based the following: a. The known and anticipated values provided above. b. The client has also asked to perform a best case scenario analysis with the following data (in addition to the known data provided above) Anticipated annual operating costs = $58,000 per year that increase $5,000 per year. Anticipated Additional maintenance at year 4 = $40,000 Anticipated annual revenue = $320,000 per year than increases $9,000 per year. Anticipated salvage value = $650,000. The client has also asked to perform a worst case scenario analysis with the following data (in addition to the known data provided above) Anticipated annual operating costs = $82,000 per year that increase $10,000 per year. Anticipated Additional maintenance at year 4 = $75,000 Anticipated annual revenue = $250,000 per year than increases $6,000 per year. Anticipated salvage value = $500,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts