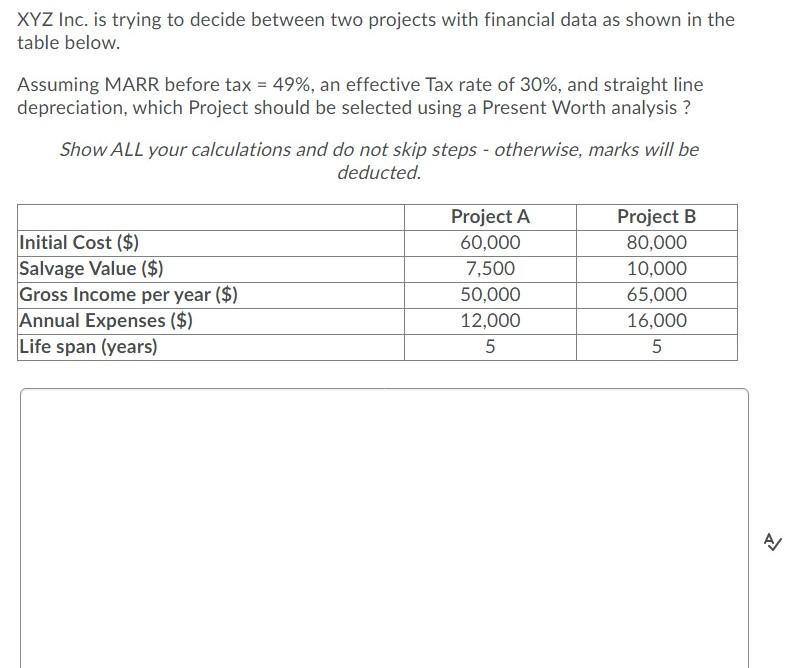

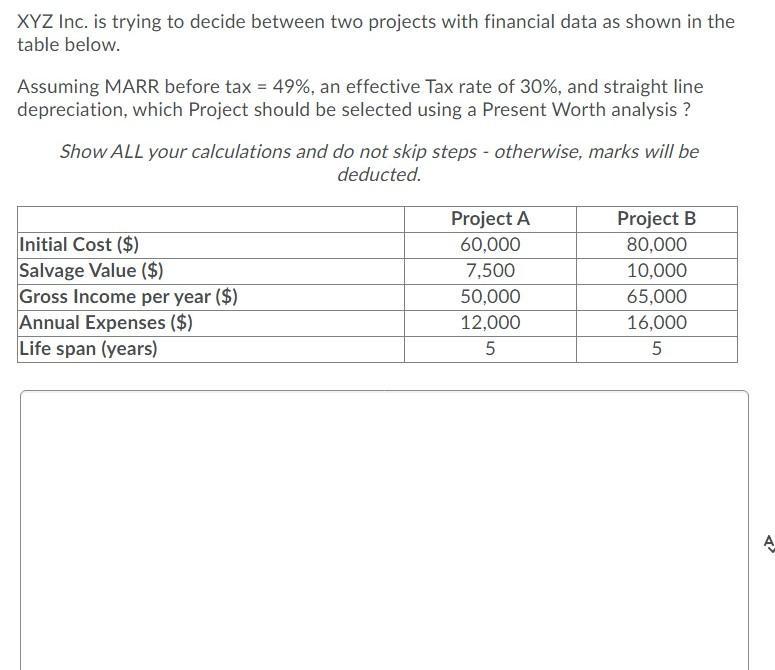

Question: XYZ Inc. is trying to decide between two projects with financial data as shown in the table below. Assuming MARR before tax = 49%,

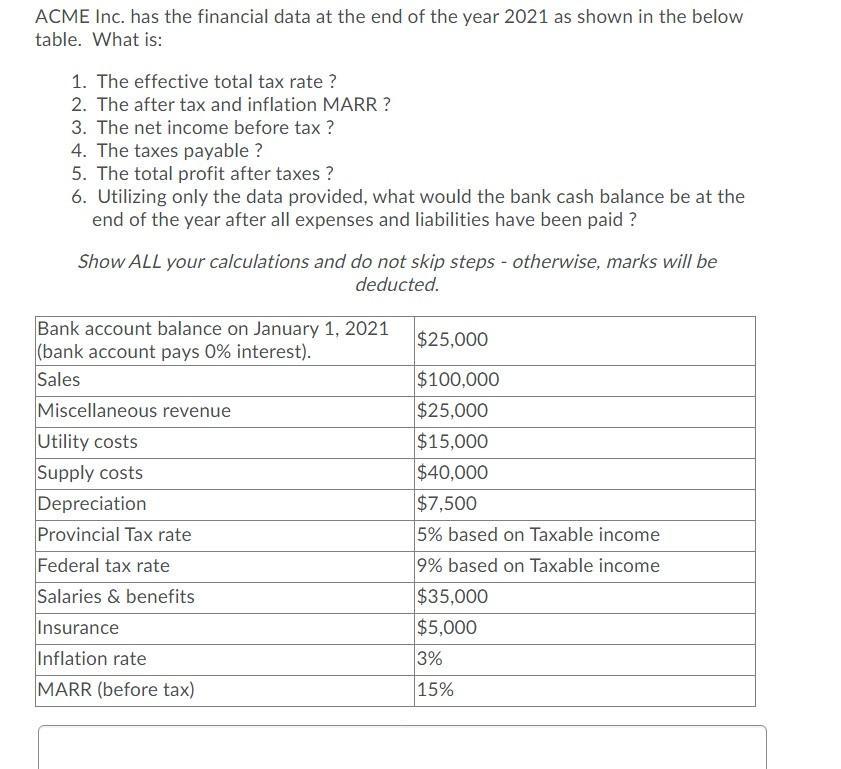

XYZ Inc. is trying to decide between two projects with financial data as shown in the table below. Assuming MARR before tax = 49%, an effective Tax rate of 30%, and straight line depreciation, which Project should be selected using a Present Worth analysis ? Show ALL your calculations and do not skip steps - otherwise, marks will be deducted. Project A Project B Initial Cost ($) Salvage Value ($) Gross Income per year ($) Annual Expenses ($) Life span (years) 60,000 7,500 80,000 10,000 50,000 65,000 12,000 16,000 ACME Inc. has the financial data at the end of the year 2021 as shown in the below table. What is: 1. The effective total tax rate ? 2. The after tax and inflation MARR ? 3. The net income before tax ? 4. The taxes payable ? 5. The total profit after taxes ? 6. Utilizing only the data provided, what would the bank cash balance be at the end of the year after all expenses and liabilities have been paid ? Show ALL your calculations and do not skip steps - otherwise, marks will be deducted. Bank account balance on January 1, 2021 (bank account pays 0% interest). Sales $25,000 $100,000 Miscellaneous revenue Utility costs Supply costs Depreciation Provincial Tax rate Federal tax rate Salaries & benefits Insurance Inflation rate $25,000 $15,000 $40,000 $7,500 5% based on Taxable income 9% based on Taxable income $35,000 $5,000 3% MARR (before tax) 15% XYZ Inc. is trying to decide between two projects with financial data as shown in the table below. Assuming MARR before tax = 49%, an effective Tax rate of 30%, and straight line depreciation, which Project should be selected using a Present Worth analysis ? Show ALL your calculations and do not skip steps - otherwise, marks will be deducted. Project A Project B Initial Cost ($) Salvage Value ($) Gross Income per year ($) Annual Expenses ($) Life span (years) 60,000 80,000 7,500 10,000 50,000 65,000 12,000 16,000

Step by Step Solution

There are 3 Steps involved in it

MARR before tax 49 Tax rate 30 MARR after tax 49 130 343 Annual depreciatio... View full answer

Get step-by-step solutions from verified subject matter experts