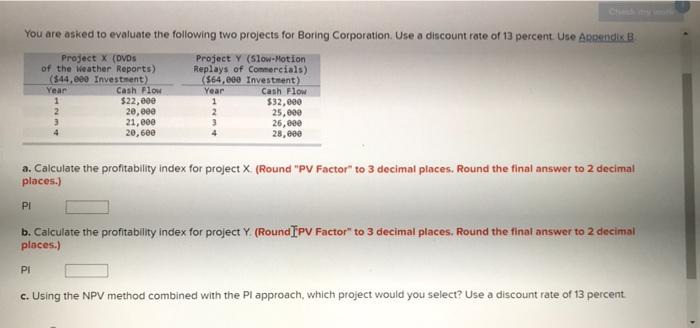

Question: You are asked to evaluate the following two projects for Boring Corporation. Use a discount rate of 13 percent. Use Appendix B a. Calculate the

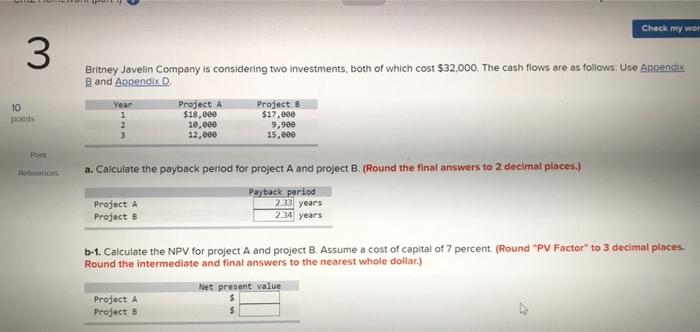

You are asked to evaluate the following two projects for Boring Corporation. Use a discount rate of 13 percent. Use Appendix B a. Calculate the profitability index for project X. (Round "PV Factor" to 3 decimal places, Round the final answer to 2 decimal places.) Pi b. Calculate the profitability index for project Y. (Round]PPV Factor" to 3 decimal places. Round the final answer to 2 decimal places.) PI c. Using the NPV method combined with the PI approach, which project would you select? Use a discount rate of 13 percent. Britney Javelin Company is considering two investments, both of which cost $32,000. The cash flows are as follows: Use Anpendix B and Appendix. a. Calculate the payback period for project A and project B. (Round the final answers to 2 decimal places.) b-1. Calculate the NPV for project A and project B. Assume a cost of capital of 7 percent. (Round "PV Factor" to 3 decimal places. Round the intermediate and final answers to the nearest whole dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts