Question: You are assessing two independent projects using the NPV technique. You note that the cash flows of Project A are as follows: Year 0 =

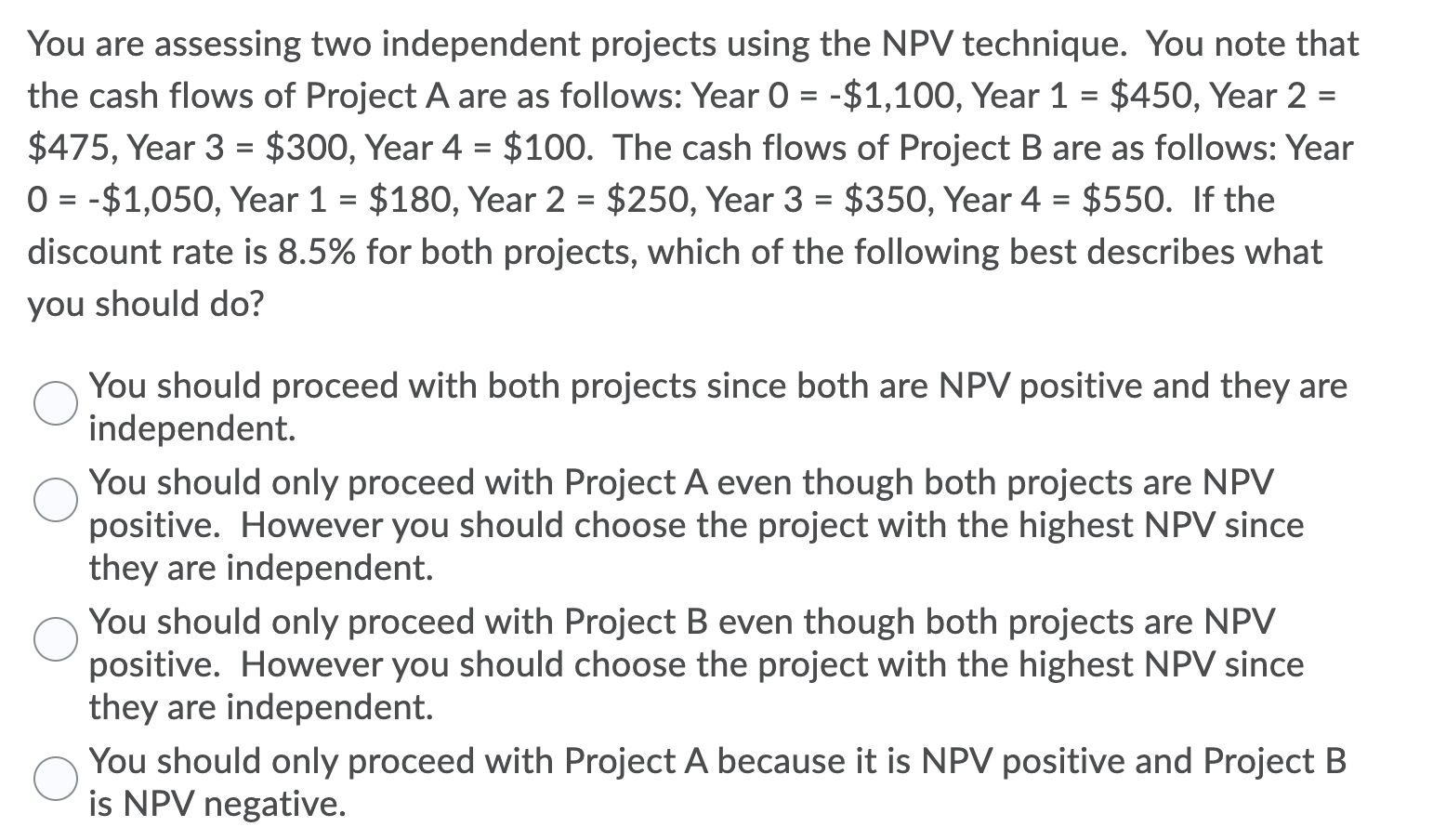

You are assessing two independent projects using the NPV technique. You note that the cash flows of Project A are as follows: Year 0 = -$1,100, Year 1 = $450, Year 2 = $475, Year 3 = $300, Year 4 = $100. The cash flows of Project B are as follows: Year O = -$1,050, Year 1 = $180, Year 2 = $250, Year 3 = $350, Year 4 = $550. If the discount rate is 8.5% for both projects, which of the following best describes what you should do? You should proceed with both projects since both are NPV positive and they are independent. You should only proceed with Project A even though both projects are NPV positive. However you should choose the project with the highest NPV since they are independent. You should only proceed with Project B even though both projects are NPV positive. However you should choose the project with the highest NPV since they are independent. You should only proceed with Project A because it is NPV positive and Project B is NPV negative

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts