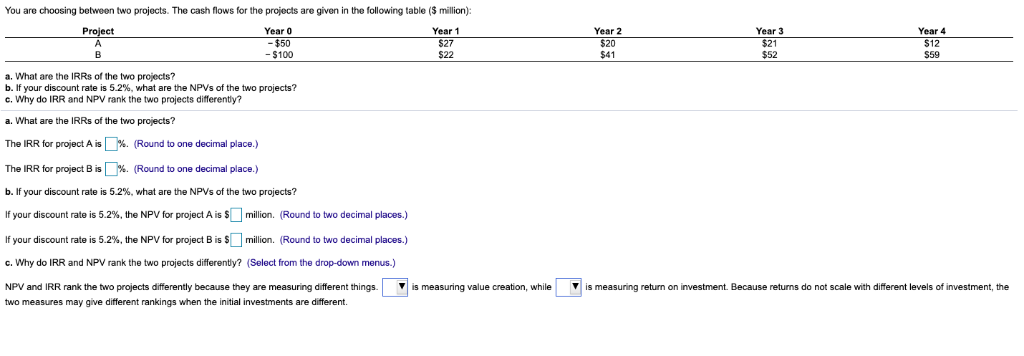

Question: You are choosing between two projects. The cash flows for the projects are given in the following table (3 million): Year 0 - $50 $100

You are choosing between two projects. The cash flows for the projects are given in the following table (3 million): Year 0 - $50 $100 Year 1 S27 S22 Year 2 $20 $41 Year 3 $21 $52 Year 4 $59 a. What are the IRRs of the two projects? b. If your discount rate is 5.2%, what are the NPVs of the two projects? c. Why do IRR and NPV rank the two projects differently? a. What are the IRRs of the two projects? The IRR for project A is The IRR for project B is b. If your discount rate is 5.2%, what are the NPVs of the two projects? If your discount rate is 5.2%. the NPV for project A is $ 1 million. (Round to two decimal places.) If your discount rate is 5.2%, the NPV for project Bis S million. Round to two decimal places. c. Why do IRR and NPV rank the two projects differenty? (Select from the drop-down menus.) NPV and R rank the two projects differently because they are measunng different hings is measuring value creation, while [ [ %. (Round to one decimal place.) %. ( Round to one decimal place.) vestment. Because returns do not scale with different levels oinvestment, the is measur ng retum on initial investments are may give different rankings when the i different

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts