Question: You are conducting your preliminary analytical procedures based on the background information for RPL. a) Apply analytical procedures to the financial report information of RPL

You are conducting your preliminary analytical procedures based on the background information for RPL.

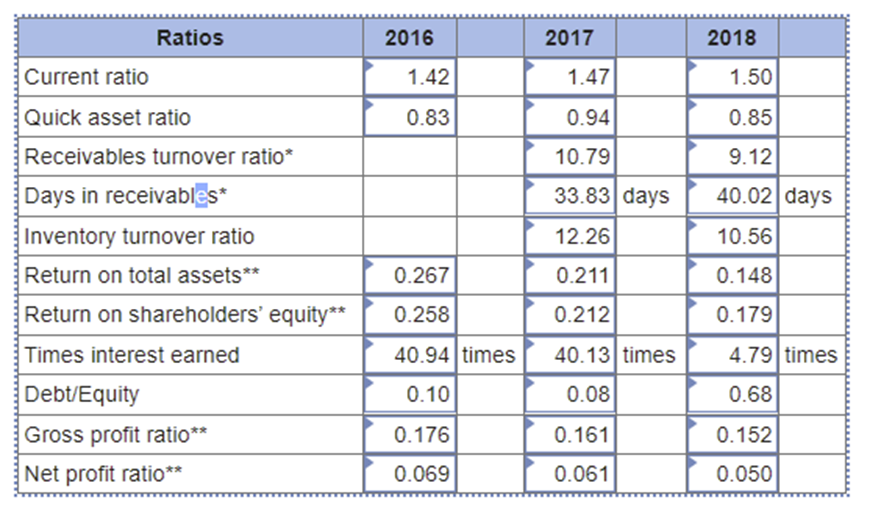

a) Apply analytical procedures to the financial report information of RPL for the past three years and complete the following table of ratios. Calculate to 2 decimal points, unless otherwise specified.

Ratios 2016 2017 2018 Current ratio 1.42 1.47 1.50 Quick asset ratio 0.83 0.94 0.85 Receivables turnover ratio* 10.79 9.12 Days in receivables* 33.83 days 40.02 days Inventory turnover ratio 12.26 10.56 Return on total assets** 0.267 0.211 0.148 Return on shareholders' equity** 0.258 0.212 0.179 Times interest earned 40.94 times 40.13 times 4.79 times Debt/Equity 0.10 0.08 0.68 Gross profit ratio** 0.176 0.161 0.152 Net profit ratio** 0.069 0.061 0.050

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts