Question: You are conducting your preliminary analytical procedures based on the background information for RPL. Apply analytical procedures to the financial report information of RPL for

You are conducting your preliminary analytical procedures based on the background information for RPL.

- Apply analytical procedures to the financial report information of RPL for the past three years and complete the following table of ratios. Calculate to 2 decimal points, unless otherwise specified.

NB: Refer to the background information of the running case study

Ratio | 2013 | 2014 | 2015 |

Current Assets | |||

Quick Assets | |||

Inventory Turnover | |||

Gross Profit Ratio | |||

Net Profit Ratio | |||

Return on Total Assets |

- Choose any 3 of the ratios in (a) and Comment on your calculations

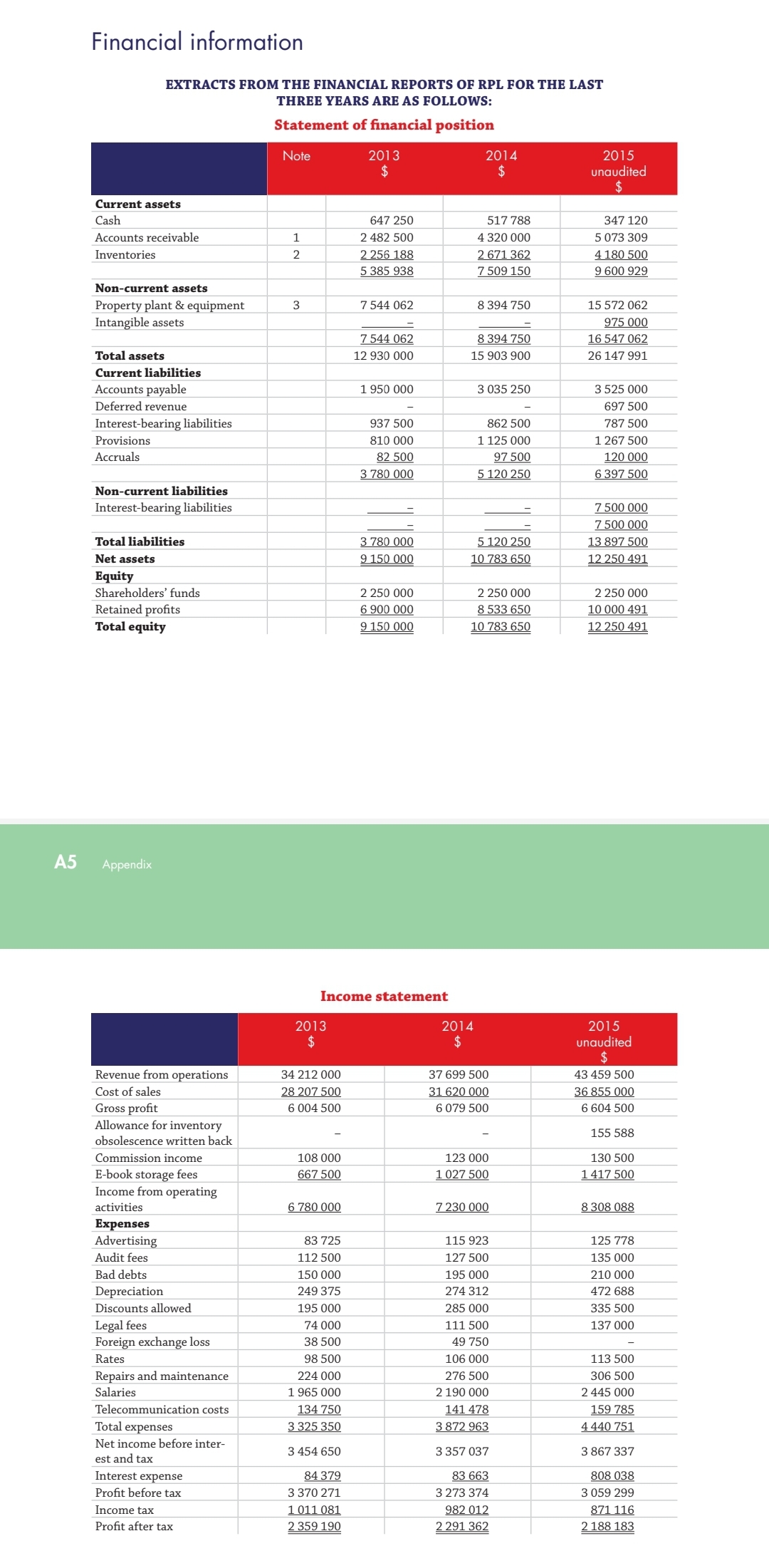

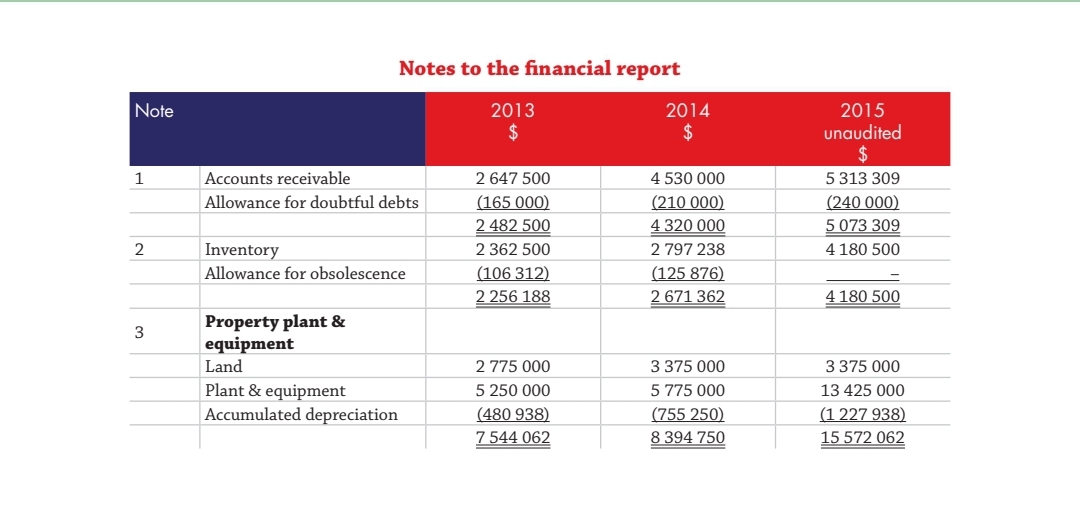

Financial information EXTRACTS FROM THE FINANCIAL REPORTS OF RPL FOR THE LAST THREE YEARS ARE AS FOLLOWS: Statement of financial position Note 2013 2014 2015 $ $ unaudited $ Current assets Cash 647 250 517 788 347 120 Accounts receivable 2 482 500 4 320 000 5 073 309 N Inventories 2 256 188 2 671 362 4 180 500 5 385 938 7 509 150 9 600 929 Non-current assets Property plant & equipment 3 7 544 062 8 394 750 15 572 062 Intangible assets 975 000 7 544 062 8 394 750 16 547 062 Total assets 12 930 000 15 903 900 26 147 991 Current liabilities Accounts payable 1 950 000 3 035 250 3 525 000 Deferred revenue 697 500 Interest-bearing liabilities 937 500 862 500 787 500 Provisions 810 000 1 125 000 1 267 500 Accruals 82 500 97 500 120 000 3 780 000 5 120 250 6 397 500 Non-current liabilities Interest-bearing liabilities 7 500 000 7 500 000 Total liabilities 3 780 000 5 120 250 13 897 500 Net assets 9 150 000 10 783 650 12 250 491 Equity Shareholders' funds 2 250 000 2 250 000 2 250 000 Retained profits 6 900 000 8 533 650 10 000 491 Total equity 9 150 000 10 783 650 12 250 491 A5 Appendix Income statement 2013 2014 2015 $ $ unaudited $ Revenue from operations 34 212 000 37 699 500 43 459 500 Cost of sales 28 207 500 31 620 000 36 855 000 Gross profit 6 004 500 6 079 500 6 604 500 Allowance for inventory 155 588 obsolescence written back Commission income 108 000 123 000 130 500 E-book storage fees 667 500 1 027 500 1 417 500 Income from operating activities 6 780 000 7 230 000 8 308 088 Expenses Advertising 83 725 115 923 125 778 Audit fees 112 500 127 500 135 000 Bad debts 150 000 195 000 210 000 Depreciation 249 375 274 312 472 688 Discounts allowed 195 000 285 000 335 500 Legal fees 74 000 111 500 137 000 Foreign exchange loss 38 500 49 750 Rates 98 500 106 000 113 500 Repairs and maintenance 224 000 276 500 306 500 Salaries 1 965 000 2 190 000 2 445 000 Telecommunication costs 134 750 141 478 159 785 Total expenses 3 325 350 3 872 963 4 440 751 Net income before inter- 3 454 650 3 357 037 3 867 337 est and tax Interest expense 84 379 83 663 808 038 Profit before tax 3 370 271 3 273 374 3 059 299 Income tax 1 011 081 982 012 871 116 Profit after tax 2 359 190 2 291 362 2 188 183Notes to the financial report Note 2013 2014 2015 $ $ unaudited $ 1 Accounts receivable 2 647 500 4 530 000 5 313 309 Allowance for doubtful debts (165 000) (210 000) (240 000) 2 482 500 4 320 000 5 073 309 2 Inventory 2 362 500 2 797 238 4 180 500 Allowance for obsolescence (106 312) (125 876) 2 256 188 2 671 362 4 180 500 3 Property plant & equipment Land 2 775 000 3 375 000 3 375 000 Plant & equipment 5 250 000 5 775 000 13 425 000 Accumulated depreciation (480 938) (755 250) (1 227 938) 7 544 062 8 394 750 15 572 062

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts