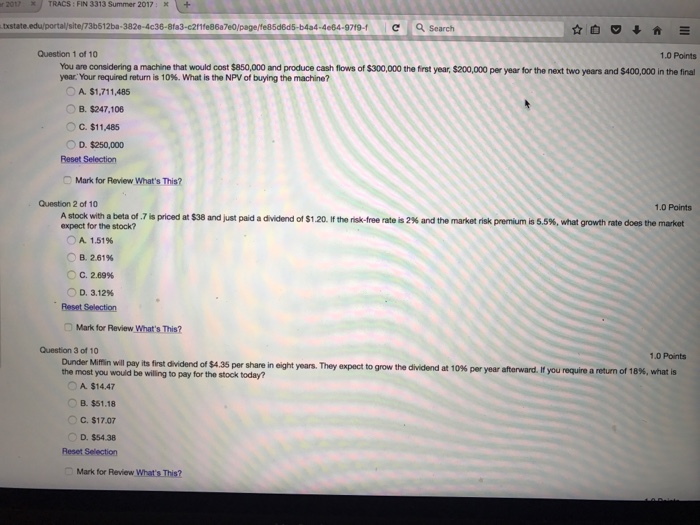

Question: You are considering a machine that would cost exist850,000 and produce cash flows of exist300,000 the first year, exist200,000 per year for the next two

You are considering a machine that would cost exist850,000 and produce cash flows of exist300,000 the first year, exist200,000 per year for the next two years and exist400,000 in the final year. your required return is 10%. What is the NPV of buying the machine? A. exist1, 711, 485 B. exist247, 106 C. exist11, 485 D. exist250,000 A stock with a beta of 7 is priced at exist38 and just paid a dividend of exist1.20. If the risk-free rate is 2% and the marked risk premium is 5.5%, what growth rate does the market expect for the stock? A. 1.51% B. 2.61% C. 2.69% D. 3.12% Dunder Miffin will pay its first dividend of exist4.35 per share in eight years. They expect to grow the dividend at 10% per year afterwards. If you required a return of 18%, what is the most you would be willing to pay for the stock today? A. exist14.47 B. exist51.18 C. exist17.07 D. exist54.38

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts