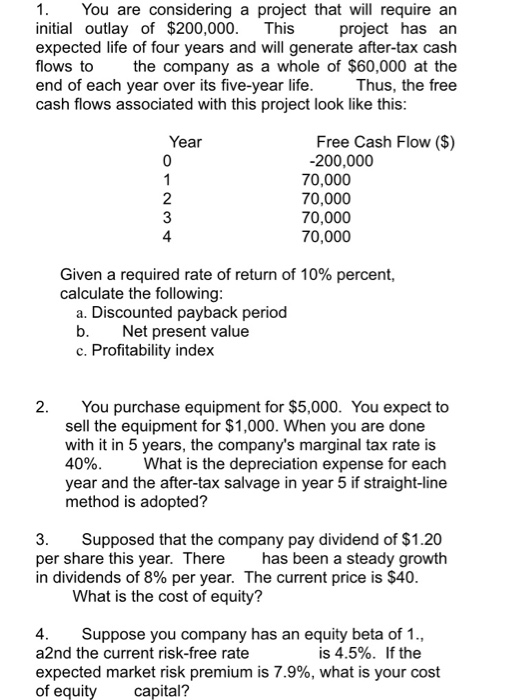

Question: You are considering a project that will require an project has an expected life of four years and will generate after-tax cash the company as

You are considering a project that will require an project has an expected life of four years and will generate after-tax cash the company as a whole of $60,000 at the Thus, the free 1. initial outlay of $200,000. This flows to end of each year over its five-year life cash flows associated with this project look like this: Free Cash Flow (S) 200,000 70,000 70,000 70,000 70,000 Year 0 1 2 3 4 Given a required rate of return of 10% percent, calculate the following: a. Discounted payback period b. Net present value c. Profitability index 2 You purchase equipment for $5,000. You expect to sell the equipment for $1,000. When you are done with it in 5 years, the company's marginal tax rate is 40% year and the after-tax salvage in year 5 if straight-line method is adopted? What is the depreciation expense for each Supposed that the company pay dividend of $1.20 per share this year. There in dividends of 8% per year. The current price is $40. What is the cost of equity? 3. has been a steady growth Suppose you company has an equity beta of 1. a2nd the current risk-free rate expected market risk premium is 7.9%, what is your cost of equity 4. is 4.5%. If the capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts