You are considering purchasing a restaurant franchise. You have projected that the franchise will earn $120,000...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

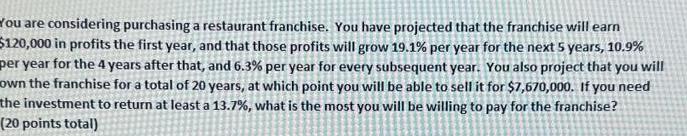

You are considering purchasing a restaurant franchise. You have projected that the franchise will earn $120,000 in profits the first year, and that those profits will grow 19.1% per year for the next 5 years, 10.9% per year for the 4 years after that, and 6.3% per year for every subsequent year. You also project that you will own the franchise for a total of 20 years, at which point you will be able to sell it for $7,670,000. If you need the investment to return at least a 13.7%, what is the most you will be willing to pay for the franchise? (20 points total) You are considering purchasing a restaurant franchise. You have projected that the franchise will earn $120,000 in profits the first year, and that those profits will grow 19.1% per year for the next 5 years, 10.9% per year for the 4 years after that, and 6.3% per year for every subsequent year. You also project that you will own the franchise for a total of 20 years, at which point you will be able to sell it for $7,670,000. If you need the investment to return at least a 13.7%, what is the most you will be willing to pay for the franchise? (20 points total)

Expert Answer:

Answer rating: 100% (QA)

To determine the maximum amount you should be willing to pay for the franchise well need to calculate the present value of all the projected cash flow... View the full answer

Related Book For

Data Analysis and Decision Making

ISBN: 978-0538476126

4th edition

Authors: Christian Albright, Wayne Winston, Christopher Zappe

Posted Date:

Students also viewed these corporate finance questions

-

Healthwise Hospital has a hybrid EHR system where paper records are scanned into the system upon patient discharge. What should the HIM department do with the paper records after the scanning process...

-

Planning is one of the most important management functions in any business. A front office managers first step in planning should involve determine the departments goals. Planning also includes...

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

Consider the example in Exhibit 5.5. Can you think of anything else you might do with that example that would be helpful to the ultimate decisionmaker? exhibit 5.5 Decision Tree Analysis Using Net...

-

Depreciation for Fractional Periods On March 10, 2012, No Doubt Company sells equipment that it purchased for $240,000 on August 20, 2005. It was originally estimated that the equipment would have a...

-

Let °U = R and let I = Z+. For each n Z+ let An = [-2n, 3n]. Determine each of the following: (a) A3 (b) A4 (c) A3 - A4 (d) A3 A4 (e) (f) (g) (h) y A 1-1 U A

-

Lydia Cruz-Moore, an employee of the nonprofit organization Hispanics United of Buffalo, expressed concerns to fellow employee Marianna Cole-Rivera that she and other employees were not doing enough...

-

Tech is playing State in the last conference game of the season. Tech is trailing State 21 to 14, with 7 seconds left in the game, when Tech scores a touchdown. Still trailing 21 to 20, Tech can...

-

1. 49 The value of n(n+n+1) is equal to (10a) [10a-3. The value of (a + ) is n=1 48 47 46 2 1 2. If + + + + + = (2)(3) (3)(4) (4)(5) (48)(49) (49)+(50) k is equal to 3. +++++ Then 4. 5. In a...

-

Pay Corporation acquired a 75 percent interest in Sue Corporation for $600,000 on January 1, 2011, when Sue's equity consisted of $300,000 capital stock and $100,000 retained earnings. The fair...

-

Use the NPV method to determine whether Root Products should invest in the foilowing projects: Project A: Costs $275.000 and offers aight annual net cash infows of $53,000. Root Products requires an...

-

What are some drawbacks to the Standard Agenda approach to decision making?

-

Should you expect some group members to become more assertive and outspoken participators in small groups, even though this is not highly valued in their culture?

-

Katniss and Peeta become targets of the Capitol following their victory in the 74th Hunger Games, which ignites rebellion. Identify and analyze informal role emergence and roles that each character...

-

This is a terrific sequel to the initial reboot of the Star Trek motion picture series. Analyze Captain Kirks (Chris Pine) leadership style. Does he adapt to the situation by changing his style to...

-

Explain the circumstances in which residual income is preferable as a measure of divisional performance.

-

Please explain how the terms support the Thesis in the outline. Essay Outline 11 Evaluate the extent to which the Mexican-American War (1846-1848) marked a turning point in the debate over slavery in...

-

On average there are four traffic accidents in a city during one hour of rush-hour traffic. Use the Poisson distribution to calculate the probability that in one such hour there arc (a) No accidents...

-

Change the new car simulation from Example 16.4 as follows. It is the same as before for years 1 through 5, including depreciation through year 5. However, the car might sell through year 10. Each...

-

A version of simple exponential smoothing can be used to predict the outcome of sporting events. To illustrate, consider pro football. Assume for simplicity that all games are played on a neutral...

-

The file S02_02.xlsx contains data about 211 movies released in 2006 and 2007. The question to be explored in this problem is whether the total gross for a movie can be predicted from how it does in...

-

The magical elevator. There is a man who lives on the top floor of a very tall building. Every day he gets the elevator down to the ground floor to leave the building to go to work. Upon returning...

-

A murderer is condemned to death. He has to choose between three rooms. The first is full of raging fires, the second is full of assassins with loaded guns, and the third is full of lions that havent...

-

A man went outside without an umbrella or a raincoat, yet did not get wet.

Study smarter with the SolutionInn App