Question: You are considering replacing a current machine with a new machine that has an 8 -year life. The purchase price of the new machine is

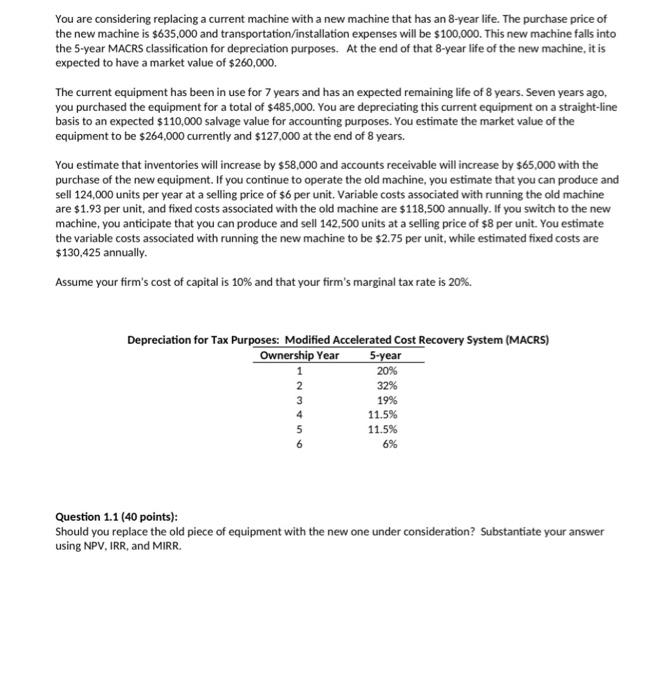

You are considering replacing a current machine with a new machine that has an 8 -year life. The purchase price of the new machine is $635,000 and transportation/installation expenses will be $100,000. This new machine falls into the 5-year MACRS classification for depreciation purposes. At the end of that 8-year life of the new machine, it is expected to have a market value of $260,000. The current equipment has been in use for 7 years and has an expected remaining life of 8 years. Seven years ago, you purchased the equipment for a total of $485,000. You are depreciating this current equipment on a straight-line basis to an expected $110,000 salvage value for accounting purposes. You estimate the market value of the equipment to be $264,000 currently and $127,000 at the end of 8 years. You estimate that inventories will increase by $58,000 and accounts receivable will increase by $65,000 with the purchase of the new equipment. If you continue to operate the old machine, you estimate that you can produce and sell 124,000 units per year at a selling price of $6 per unit. Variable costs associated with running the old machine are $1.93 per unit, and fixed costs associated with the old machine are $118,500 annually. If you switch to the new machine, you anticipate that you can produce and sell 142,500 units at a selling price of $8 per unit. You estimate the variable costs associated with running the new machine to be $2.75 per unit, while estimated fixed costs are $130,425 annually. Assume your firm's cost of capital is 10% and that your firm's marginal tax rate is 20%. Depreciation for Tax Purposes: Modified Accelerated Cost Recovery System (MACRS) Question 1.1 (40 points): Should you replace the old piece of equipment with the new one under consideration? Substantiate your answer using NPV, IRR, and MIRR. Part Two: Modifications of Base Case (24 points) To improve the accuracy of your Part One analysis, there are two adjustments you believe should be incorporated. First, it is possible that your estimated unit sales generated from the new machine will grow at a 2.0% annual rate beginning in year two of your analysis. 1 Second, you now realize that you failed to incorporate inflation expectations into your cash flow estimates. Assume that the unit selling price, variable costs, and fixed costs for both the current and new machine under consideration will grow at a 0.85% annual rate of inflation beginning in year two of your analysis. Question 2.1: (14 points) Rerun your analysis from Part One incorporating these adjustments. Does your original recommendation hold? Part 2 (Cont.): NWC In addition to the growth and inflation assumptions incorporated above, assume that you also expect net working capital demands to fluctuate with revenue. Specifically, you expect the necessary net working capital investment to be 13% of the contemporaneous (i.e. of the same year) revenue projections for the new machine for each year. Assume the initial net working capital investment assumption still holds. Question 2.2: (10 points) Rerun your analysis for Part Two incorporating these additional adjustments. Does your original recommendation hold? You are considering replacing a current machine with a new machine that has an 8 -year life. The purchase price of the new machine is $635,000 and transportation/installation expenses will be $100,000. This new machine falls into the 5-year MACRS classification for depreciation purposes. At the end of that 8-year life of the new machine, it is expected to have a market value of $260,000. The current equipment has been in use for 7 years and has an expected remaining life of 8 years. Seven years ago, you purchased the equipment for a total of $485,000. You are depreciating this current equipment on a straight-line basis to an expected $110,000 salvage value for accounting purposes. You estimate the market value of the equipment to be $264,000 currently and $127,000 at the end of 8 years. You estimate that inventories will increase by $58,000 and accounts receivable will increase by $65,000 with the purchase of the new equipment. If you continue to operate the old machine, you estimate that you can produce and sell 124,000 units per year at a selling price of $6 per unit. Variable costs associated with running the old machine are $1.93 per unit, and fixed costs associated with the old machine are $118,500 annually. If you switch to the new machine, you anticipate that you can produce and sell 142,500 units at a selling price of $8 per unit. You estimate the variable costs associated with running the new machine to be $2.75 per unit, while estimated fixed costs are $130,425 annually. Assume your firm's cost of capital is 10% and that your firm's marginal tax rate is 20%. Depreciation for Tax Purposes: Modified Accelerated Cost Recovery System (MACRS) Question 1.1 (40 points): Should you replace the old piece of equipment with the new one under consideration? Substantiate your answer using NPV, IRR, and MIRR. Part Two: Modifications of Base Case (24 points) To improve the accuracy of your Part One analysis, there are two adjustments you believe should be incorporated. First, it is possible that your estimated unit sales generated from the new machine will grow at a 2.0% annual rate beginning in year two of your analysis. 1 Second, you now realize that you failed to incorporate inflation expectations into your cash flow estimates. Assume that the unit selling price, variable costs, and fixed costs for both the current and new machine under consideration will grow at a 0.85% annual rate of inflation beginning in year two of your analysis. Question 2.1: (14 points) Rerun your analysis from Part One incorporating these adjustments. Does your original recommendation hold? Part 2 (Cont.): NWC In addition to the growth and inflation assumptions incorporated above, assume that you also expect net working capital demands to fluctuate with revenue. Specifically, you expect the necessary net working capital investment to be 13% of the contemporaneous (i.e. of the same year) revenue projections for the new machine for each year. Assume the initial net working capital investment assumption still holds. Question 2.2: (10 points) Rerun your analysis for Part Two incorporating these additional adjustments. Does your original recommendation hold

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts