Question: You are considering the following two mutually exclusive projects. The required return on each project is 12 percent. Which project should you accept and what

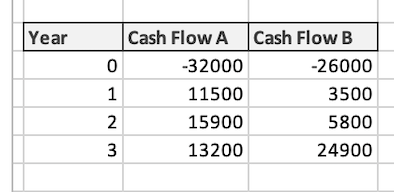

You are considering the following two mutually exclusive projects. The required return on each project is 12 percent. Which project should you accept and what is the best reason for that decision?

Hint: Use NPV function for each, then select the Project with the higher NPV, as it will bring more value to the company. The Values you use are on the right, with the NPV function.

Please solve and show work on how this was done. Thank you!

\begin{tabular}{|r|r|r|} \hline Year & Cash Flow A & Cash Flow B \\ \hline 0 & -32000 & -26000 \\ \hline 1 & 11500 & 3500 \\ \hline 2 & 15900 & 5800 \\ \hline 3 & 13200 & 24900 \\ \hline \end{tabular} \begin{tabular}{|r|r|r|} \hline Year & Cash Flow A & Cash Flow B \\ \hline 0 & -32000 & -26000 \\ \hline 1 & 11500 & 3500 \\ \hline 2 & 15900 & 5800 \\ \hline 3 & 13200 & 24900 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts