Question: You are considering the following two mutually exclusive projects. The required return on each project is 14 percent. Which project should you accept and what

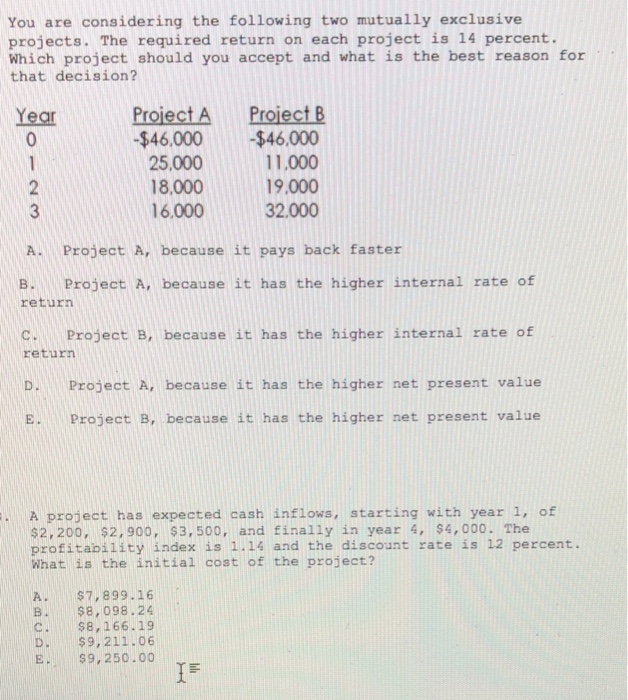

You are considering the following two mutually exclusive projects. The required return on each project is 14 percent. Which project should you accept and what is the best reason for that decision? Year Proiect A Proiect B $46,000-$46,000 11,000 18.00019.000 32.000 25,000 16,000 A. Project A, because it pays back faster B. Project A, because it has the higher internal rate of return C.Project B, because it has the higher internal rate of return D-Project A, because it has the higher net present value E. Project B, because it has the higher net present value A project has expected cash inflows, starting with year 1, of $2,200, $2, 900, $3,500, and finally in year 4, $4,000. The profitability index is 1.14 and the discount rate is 12 percent. What is the initial cost of the project? A. $7,899. 16 $8,098.24 c. s8,166.19 D.$9,211.06 E$9,250.00 IF

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts