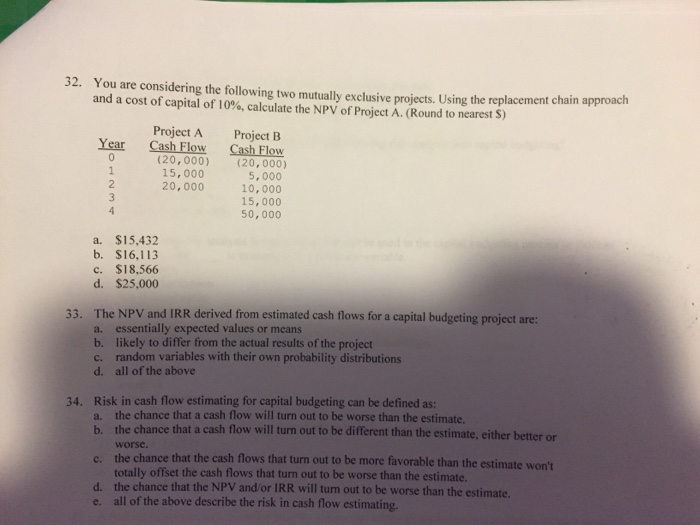

Question: You are considering the following two mutually exclusive projects. Using the replacement chain approach and a cost of capital of 10%, calculate the NPV of

You are considering the following two mutually exclusive projects. Using the replacement chain approach and a cost of capital of 10%, calculate the NPV of Project A. (Round to nearest $). $15,432 $16,113 $18,566 $25,000 The NPV and IRR derived from estimated cash flows for a capital budgeting project are: essentially expected values or means likely to differ from the actual results of the project random variables with their own probability distributions all of the above Risk in cash flow estimating for capital budgeting can be defined as: the chance that a cash flow will turn out to be worse than the estimate. the chance that a cash flow will turn out to be different than the estimate, cither better or worse. the chance that the cash flows that turn out to be more favorable than the estimate won't totally offset the cash flows that turn out to be worse than the estimate. the chance that the NPV and or IRR will turn out to be worse than the estimate. all of the above describe the risk in cash flow estimating

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts