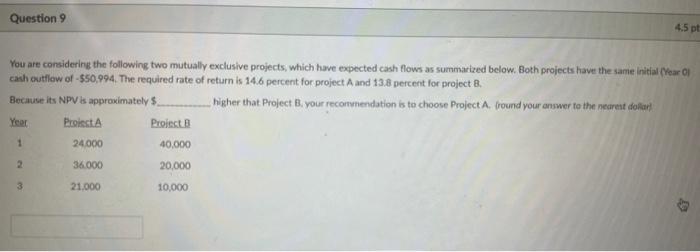

Question: You are considering the following two mutually exclusive projects, which have expected cash flows as summarized below. Both projects have the same initial (Year Of

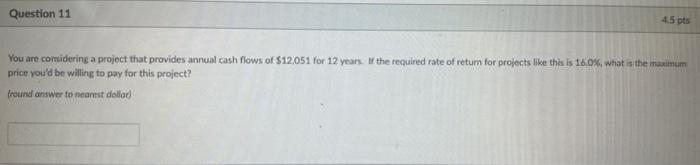

You are considering the following two mutually exclusive projects, which have expected cash flows as summarized below. Both projects have the same initial (Year Of cash exutflew of - 550,994. The required rate of return is 14.6 percent for project A and 13.8 percent for project B. Because its NPV is approximately $. higher that Project B, your recomynendation is to choose Project A. fround your answer to the nearest dollarf: You are comidering a project that provides annual cash flows of $12,051 for 12 yean. If the required rate of retum for projects like this is 16 ox, what is the maximin price you'd be willing to pay for this project? (round answer to nearest dollaid

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts