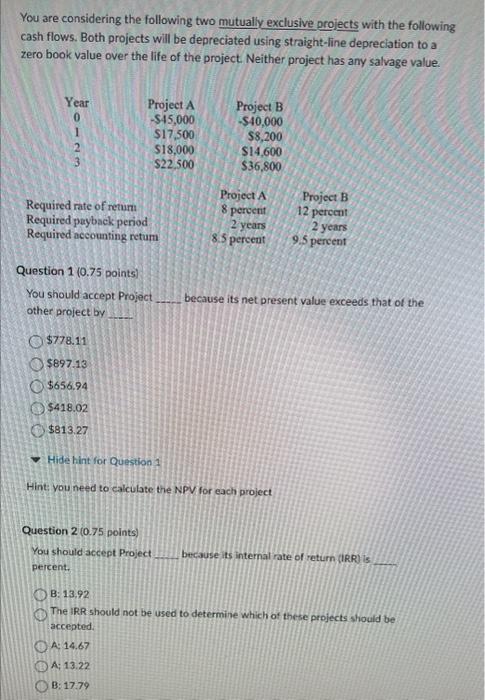

Question: You are considering the following two mutually exclusive projects with the following cash flows. Both projects will be depreciated using straight-line depreciation to a zero

You are considering the following two mutually exclusive projects with the following cash flows. Both projects will be depreciated using straight-line depreciation to a zero book value over the life of the project. Neither project has any salvage value. Question 1(0.75 points) You should accept Project because its net present value exceeds that of the other project by $778.11 $897.13 $656.94 $418.02 $813.27 Hide hint for Question 1 Hint: you need to calculate the NPV for each project Question 2 ( 0.75 points) You should accept Project percent. because its internal rate of return (IRR) is B: 13,92 The IRR should not be used to determine which of these projects should be accepted. A. 14.67 A; 13.22 B: 17.79

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts