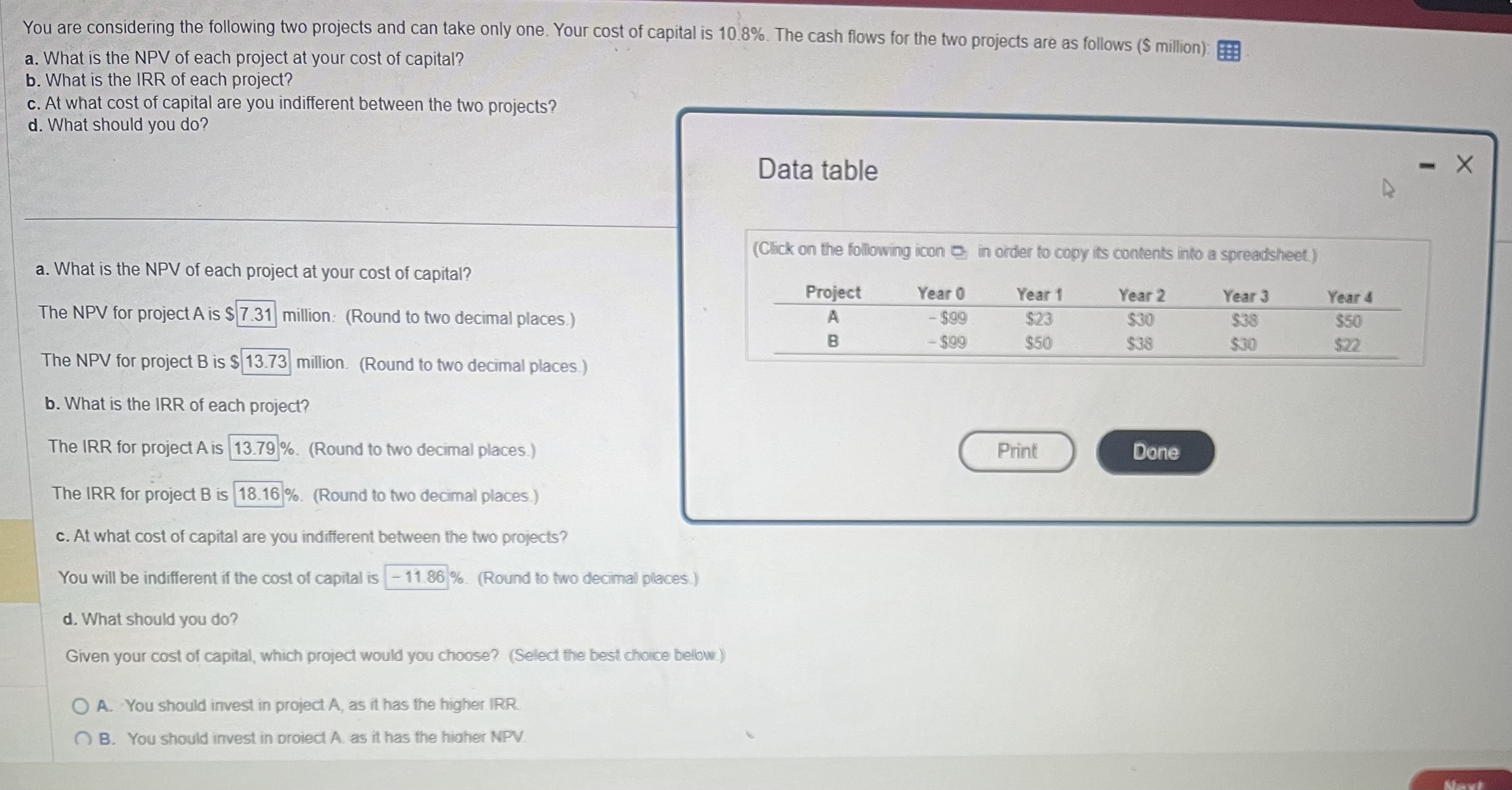

Question: You are considering the following two projects and can take only one. Your cost of capital is 10.8%. The cash flows for the two projects

You are considering the following two projects and can take only one. Your cost of capital is 10.8%. The cash flows for the two projects are as follows ( $ million): Fi: a. What is the NPV of each project at your cost of capital? b. What is the IRR of each project? c. At what cost of capital are you indifferent between the two projects? d. What should you do? Data table a. What is the NPV of each project at your cost of capital? The NPV for project A is $ million: (Round to two decimal places.) The NPV for project B is $ million. (Round to two decimal places.) b. What is the IRR of each project? The IRR for project A is \%. (Round to two decimal places.) The IRR for project B is \%. (Round to two decimal places.) c. At what cost of capital are you indifferent between the two projects? You will be indifferent if the cost of capital is (Round to two decimal places.) d. What should you do? Given your cost of capital, which project would you choose? (Select the best choice below.) A. You should invest in project A, as it has the higher IRR B. You should invest in proied A. as it has the higher NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts