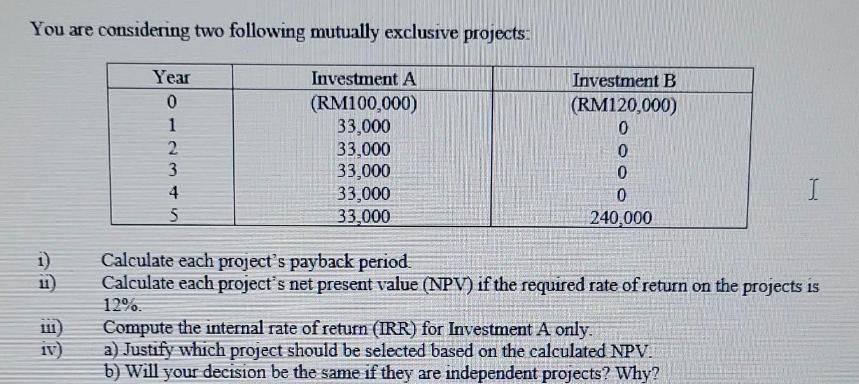

Question: You are considering two following mutually exclusive projects: 1) 111) Year 0 12345 Investment A (RM100,000) 33,000 33,000 33,000 33,000 33,000 Investment B (RM120,000)

You are considering two following mutually exclusive projects: 1) 111) Year 0 12345 Investment A (RM100,000) 33,000 33,000 33,000 33,000 33,000 Investment B (RM120,000) 0 0 0 0 240,000 I Calculate each project's payback period. Calculate each project's net present value (NPV) if the required rate of return on the projects is 12%. Compute the internal rate of return (IRR) for Investment A only. a) Justify which project should be selected based on the calculated NPV. b) Will your decision be the same if they are independent projects? Why?

Step by Step Solution

3.29 Rating (155 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provided below i Payback Per... View full answer

Get step-by-step solutions from verified subject matter experts