Question: You are considering two options for manufacturing a typical product: . You continue to use an old machine now in use which was bought 8

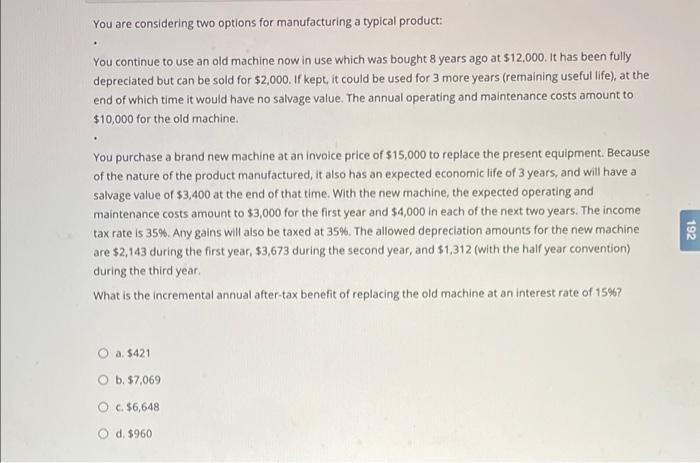

You are considering two options for manufacturing a typical product: . You continue to use an old machine now in use which was bought 8 years ago at $12,000. It has been fully depreciated but can be sold for $2,000. If kept, it could be used for 3 more years (remaining useful life), at the end of which time it would have no salvage value. The annual operating and maintenance costs amount to $10,000 for the old machine. You purchase a brand new machine at an invoice price of $15,000 to replace the present equipment. Because of the nature of the product manufactured, it also has an expected economic life of 3 years, and will have a salvage value of $3,400 at the end of that time. With the new machine, the expected operating and maintenance costs amount to $3,000 for the first year and $4,000 in each of the next two years. The income tax rate is 35%. Any gains will also be taxed at 35%. The allowed depreciation amounts for the new machine are $2,143 during the first year, $3,673 during the second year, and $1,312 (with the half year convention) during the third year. What is the incremental annual after-tax benefit of replacing the old machine at an interest rate of 15% 7 O a. $421 O b. $7,069 O c. $6,648 O d. $960 192

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts