Question: You are constructing a risky portfolio for a client, to be comprised of both an equity fund and a bond fund. The probability distributions of

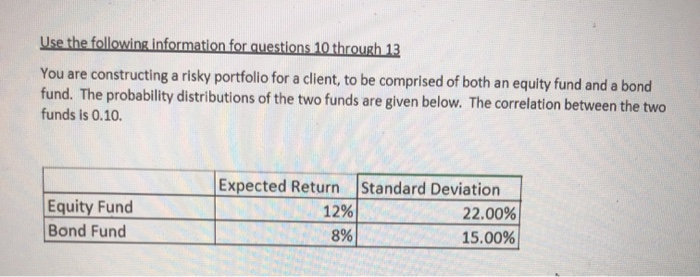

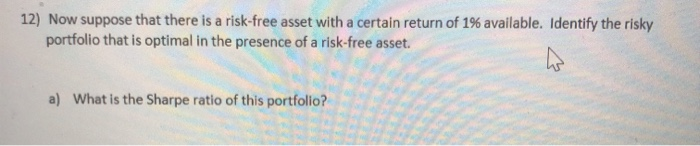

Use the following information for questions 10 through 13 You are constructing a risky portfolio for a client, to be comprised of both an equity fund and a bond fund. The probability distributions of the two funds are given below. The correlation between the two funds is 0.10. Equity Fund Bond Fund Expected Return 12% 8% Standard Deviation 22.00% 15.00% 12) Now suppose that there is a risk-free asset with a certain return of 1% available. Identify the risky portfolio that is optimal in the presence of a risk-free asset. a) What is the Sharpe ratio of this portfolio? Use the following information for questions 10 through 13 You are constructing a risky portfolio for a client, to be comprised of both an equity fund and a bond fund. The probability distributions of the two funds are given below. The correlation between the two funds is 0.10. Equity Fund Bond Fund Expected Return 12% 8% Standard Deviation 22.00% 15.00% 12) Now suppose that there is a risk-free asset with a certain return of 1% available. Identify the risky portfolio that is optimal in the presence of a risk-free asset. a) What is the Sharpe ratio of this portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts