Question: You are constructing a risky portfolio for a client, to be comprised of both an equity fund and a bond fund. The probability distributions of

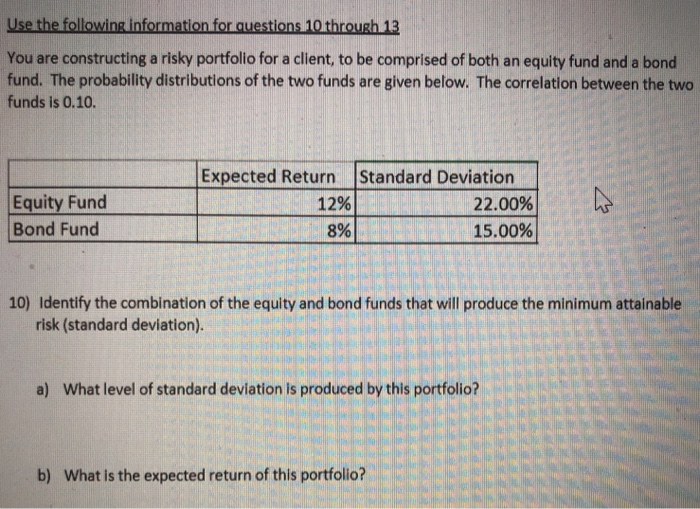

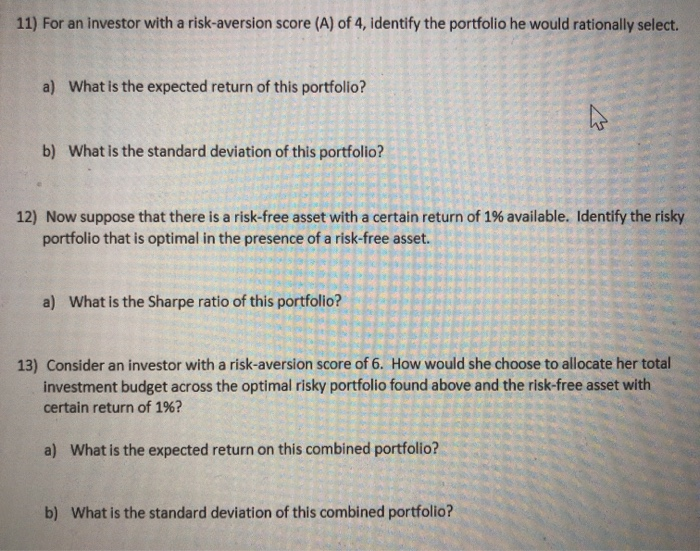

Use the following information for questions 10 through 13 You are constructing a risky portfolio for a client, to be comprised of both an equity fund and a bond fund. The probability distributions of the two funds are given below. The correlation between the two funds is 0.10. Equity Fund Bond Fund Expected Return 12% 8% Standard Deviation 22.00% 15.00% 10) Identify the combination of the equity and bond funds that will produce the minimum attainable risk (standard deviation). a) What level of standard deviation is produced by this portfolio? b) What is the expected return of this portfolio? 11) For an investor with a risk-aversion score (A) of 4, identify the portfolio he would rationally select. a) What is the expected return of this portfolio? b) What is the standard deviation of this portfolio? 12) Now suppose that there is a risk-free asset with a certain return of 1% available. Identify the risky portfolio that is optimal in the presence of a risk-free asset. a) What is the Sharpe ratio of this portfolio? 13) Consider an investor with a risk-aversion score of 6. How would she choose to allocate her total investment budget across the optimal risky portfolio found above and the risk-free asset with certain return of 1%? a) What is the expected return on this combined portfolio? b) What is the standard deviation of this combined portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts