Question: You are contemplating purchasing a 33 unit apartment building located in Madison, near the capital. Your partners have asked you to put together a

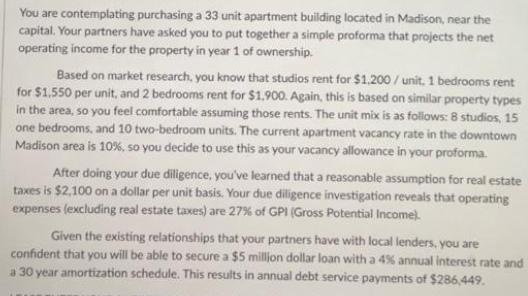

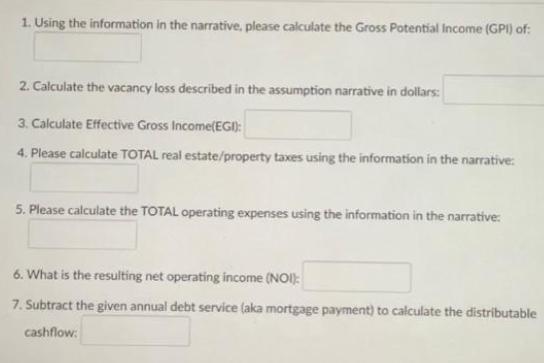

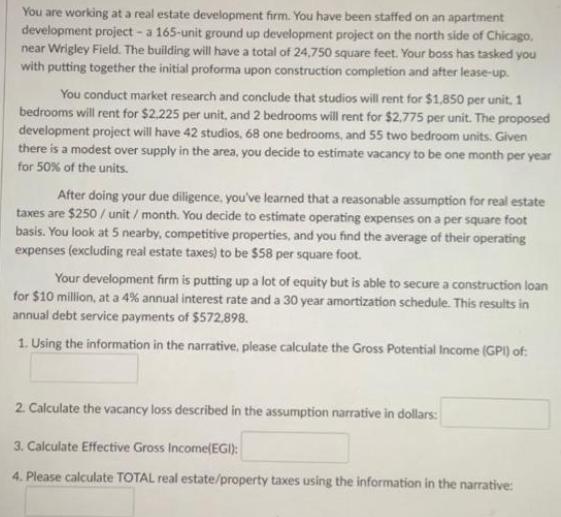

You are contemplating purchasing a 33 unit apartment building located in Madison, near the capital. Your partners have asked you to put together a simple proforma that projects the net operating income for the property in year 1 of ownership. Based on market research, you know that studios rent for $1.200/unit, 1 bedrooms rent for $1.550 per unit, and 2 bedrooms rent for $1.900. Again, this is based on similar property types in the area, so you feel comfortable assuming those rents. The unit mix is as follows: 8 studios, 15 one bedrooms, and 10 two-bedroom units. The current apartment vacancy rate in the downtown Madison area is 10%, so you decide to use this as your vacancy allowance in your proforma. After doing your due diligence, you've learned that a reasonable assumption for real estate taxes is $2,100 on a dollar per unit basis. Your due diligence investigation reveals that operating expenses (excluding real estate taxes) are 27% of GPI (Gross Potential Income). Given the existing relationships that your partners have with local lenders, you are confident that you will be able to secure a $5 million dollar loan with a 4% annual interest rate and a 30 year amortization schedule. This results in annual debt service payments of $286,449. 1. Using the information in the narrative, please calculate the Gross Potential Income (GPI) of: 2. Calculate the vacancy loss described in the assumption narrative in dollars: 3. Calculate Effective Gross Income(EGI): 4. Please calculate TOTAL real estate/property taxes using the information in the narrative: 5. Please calculate the TOTAL operating expenses using the information in the narrative: 6. What is the resulting net operating income (NOI): 7. Subtract the given annual debt service (aka mortgage payment) to calculate the distributable cashflow: You are working at a real estate development firm. You have been staffed on an apartment development project - a 165-unit ground up development project on the north side of Chicago, near Wrigley Field. The building will have a total of 24,750 square feet. Your boss has tasked you with putting together the initial proforma upon construction completion and after lease-up. You conduct market research and conclude that studios will rent for $1,850 per unit, 1 bedrooms will rent for $2.225 per unit, and 2 bedrooms will rent for $2.775 per unit. The proposed development project will have 42 studios, 68 one bedrooms, and 55 two bedroom units. Given there is a modest over supply in the area, you decide to estimate vacancy to be one month per year for 50% of the units. After doing your due diligence, you've learned that a reasonable assumption for real estate taxes are $250/unit/month. You decide to estimate operating expenses on a per square foot basis. You look at 5 nearby, competitive properties, and you find the average of their operating expenses (excluding real estate taxes) to be $58 per square foot. Your development firm is putting up a lot of equity but is able to secure a construction loan for $10 million, at a 4% annual interest rate and a 30 year amortization schedule. This results in annual debt service payments of $572,898. 1. Using the information in the narrative, please calculate the Gross Potential Income (GPI) of: 2. Calculate the vacancy loss described in the assumption narrative in dollars: 3. Calculate Effective Gross Income(EGI): 4. Please calculate TOTAL real estate/property taxes using the information in the narrative:

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

1 Gross Potential Income 331200151550101900 59500 2 Vacancy loss 5950001 5950 3 Effective Gross Inco... View full answer

Get step-by-step solutions from verified subject matter experts