Question: You are evaluating a 10 year project. Using a discount rate of 10%, you have calculated the project's NPV as $100. After completing your

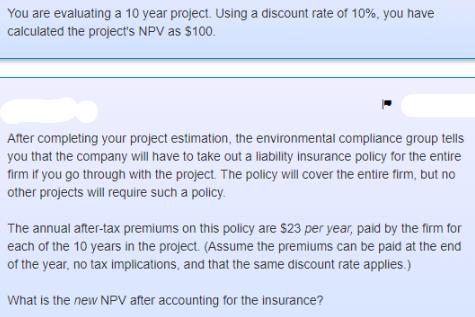

You are evaluating a 10 year project. Using a discount rate of 10%, you have calculated the project's NPV as $100. After completing your project estimation, the environmental compliance group tells you that the company will have to take out a liability insurance policy for the entire firm if you go through with the project. The policy will cover the entire firm, but no other projects will require such a policy. The annual after-tax premiums on this policy are $23 per year, paid by the firm for each of the 10 years in the project. (Assume the premiums can be paid at the end of the year, no tax implications, and that the same discount rate applies.) What is the new NPV after accounting for the insurance?

Step by Step Solution

3.43 Rating (159 Votes )

There are 3 Steps involved in it

To calculate the new NPV after accounting for the insurance premiums we need to adj... View full answer

Get step-by-step solutions from verified subject matter experts