Question: You are evaluating a call option on KO with a strike price of $137. IF KO is able to launch a new beverage line, the

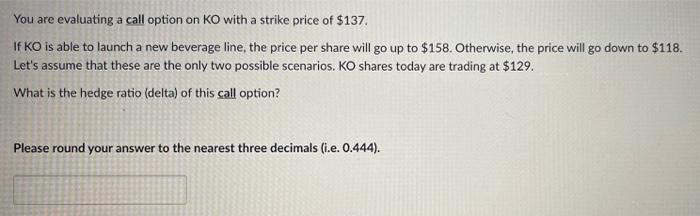

You are evaluating a call option on KO with a strike price of $137. IF KO is able to launch a new beverage line, the price per share will go up to $158. Otherwise, the price will go down to $118. Let's assume that these are the only two possible scenarios. KO shares today are trading at $129. What is the hedge ratio (delta) of this call option? Please round your answer to the nearest three decimals (i.e. 0.444)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts