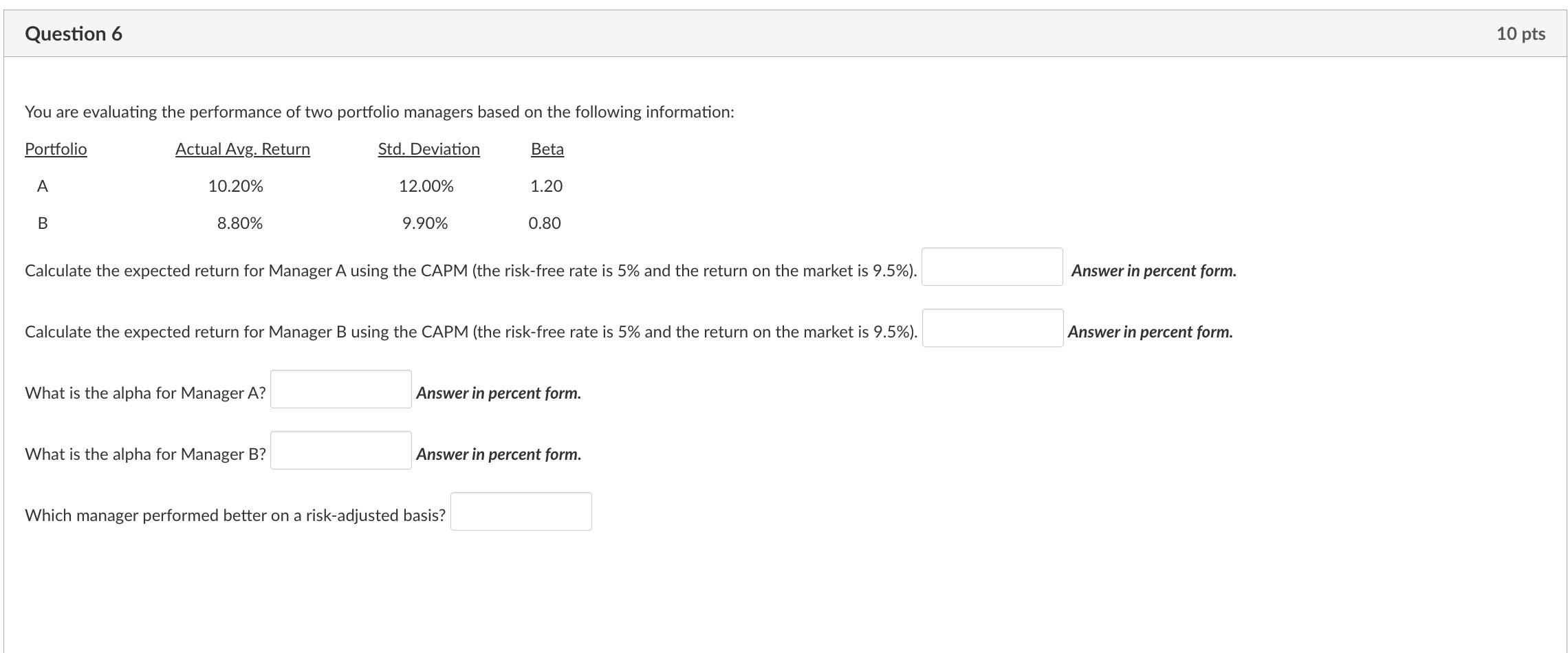

Question: You are evaluating the performance of two portfolio managers based on the following information: Calculate the expected return for Manager A using the CAPM (the

You are evaluating the performance of two portfolio managers based on the following information: Calculate the expected return for Manager A using the CAPM (the risk-free rate is 5% and the return on the market is 9.5%. Answer in percent form. Calculate the expected return for Manager B using the CAPM (the risk-free rate is 5% and the return on the market is 9.5% ). Answer in percent form. What is the alpha for Manager A? Answer in percent form. What is the alpha for Manager B? Answer in percent form. Which manager performed better on a risk-adjusted basis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts