Question: You are evaluating two projects. You may accept only one of them. Project one will cost initially and will pay $134,000 each year for the

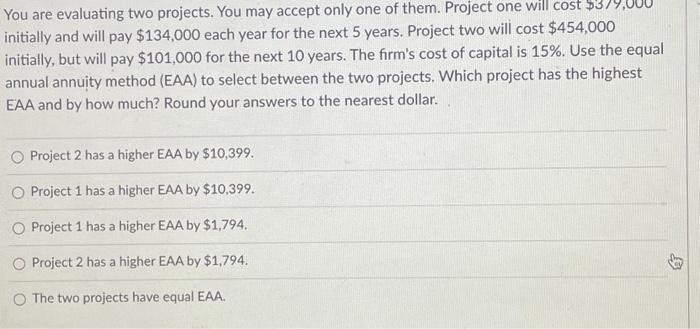

You are evaluating two projects. You may accept only one of them. Project one will cost initially and will pay $134,000 each year for the next 5 years. Project two will cost $454,000 initially, but will pay $101,000 for the next 10 years. The firm's cost of capital is 15%. Use the equal annual annuity method (EAA) to select between the two projects. Which project has the highest EAA and by how much? Round your answers to the nearest dollar. Project 2 has a higher EAA by $10,399. Project 1 has a higher EAA by $10,399. Project 1 has a higher EAA by $1,794. Project 2 has a higher EAA by $1,794. The two projects have equal EAA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts