Question: You are evaluating two quantitative factor funds Vanguard Small-Value ETF (VBR) and Blackrock's iShares MSCI USA Quality Factor ETF (QUAL). Information about the two funds

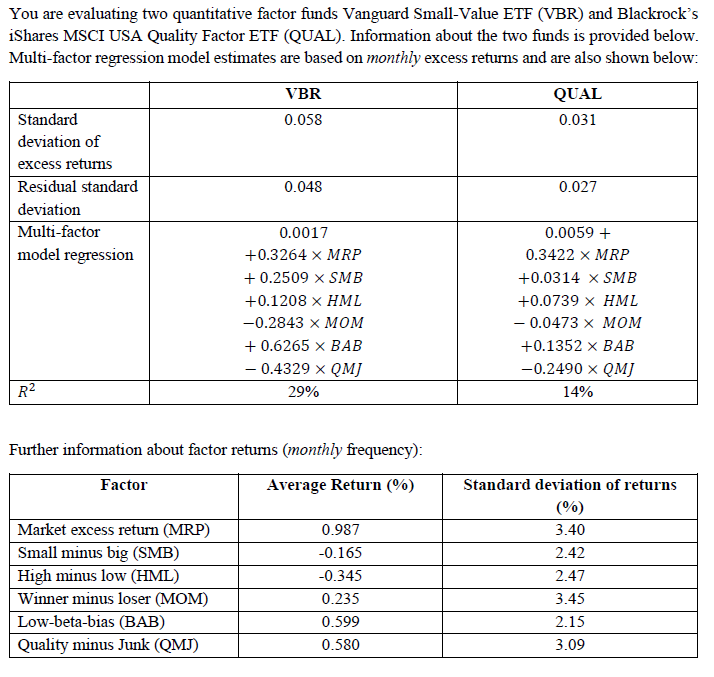

You are evaluating two quantitative factor funds Vanguard Small-Value ETF (VBR) and Blackrock's iShares MSCI USA Quality Factor ETF (QUAL). Information about the two funds is provided below. Multi-factor regression model estimates are based on monthly excess returns and are also shown below: VBR QUAL 0.058 0.031 Standard deviation of excess retums 0.048 0.027 Residual standard deviation Multi-factor 0.0017 0.0059 + model regression +0.3264 x MRP 0.3422 X MRP +0.2509 X SMB +0.0314 X SMB +0.1208 X HML +0.0739 X HML -0.2843 X MOM -0.0473 X MOM + 0.6265 X BAB +0.1352 X BAB -0.2490 X QMJ -0.4329 x QM] 29% R2 14% Further information about factor retums (monthly frequency): Factor Average Return (%) Standard deviation of returns (%) 3.40 0.987 -0.165 2.42 -0.345 2.47 Market excess return (MRP) Small minus big (SMB) High minus low (HML) Winner minus loser (MOM) Low-beta-bias (BAB) Quality minus Junk (QMJ) 0.235 3.45 0.599 2.15 0.580 3.09 Assume that all the factors are uncorrelated. A. (10 marks) For each of VBR and QUAL calculate the following: annual excess return; annual Sharpe ratio, annual Treynor ratio with respect to market beta; annual Jensen's alpha with respect to the multi-factor model; and annual information ratio with respect to the multi-factor model. B. (5 marks) Do you think the funds achieve their objectives in terms of Tracking the performance of their benchmark firms (small value for VBR and quality for QUAL)? Providing investors with diversified portfolios? Explain your answers. You are evaluating two quantitative factor funds Vanguard Small-Value ETF (VBR) and Blackrock's iShares MSCI USA Quality Factor ETF (QUAL). Information about the two funds is provided below. Multi-factor regression model estimates are based on monthly excess returns and are also shown below: VBR QUAL 0.058 0.031 Standard deviation of excess retums 0.048 0.027 Residual standard deviation Multi-factor 0.0017 0.0059 + model regression +0.3264 x MRP 0.3422 X MRP +0.2509 X SMB +0.0314 X SMB +0.1208 X HML +0.0739 X HML -0.2843 X MOM -0.0473 X MOM + 0.6265 X BAB +0.1352 X BAB -0.2490 X QMJ -0.4329 x QM] 29% R2 14% Further information about factor retums (monthly frequency): Factor Average Return (%) Standard deviation of returns (%) 3.40 0.987 -0.165 2.42 -0.345 2.47 Market excess return (MRP) Small minus big (SMB) High minus low (HML) Winner minus loser (MOM) Low-beta-bias (BAB) Quality minus Junk (QMJ) 0.235 3.45 0.599 2.15 0.580 3.09 Assume that all the factors are uncorrelated. A. (10 marks) For each of VBR and QUAL calculate the following: annual excess return; annual Sharpe ratio, annual Treynor ratio with respect to market beta; annual Jensen's alpha with respect to the multi-factor model; and annual information ratio with respect to the multi-factor model. B. (5 marks) Do you think the funds achieve their objectives in terms of Tracking the performance of their benchmark firms (small value for VBR and quality for QUAL)? Providing investors with diversified portfolios? Explain your answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts