Question: You are evaluating whether to install a new higher-voltage power transmission line. The line will cost $375,000 more initially, but it will reduce transmission losses.

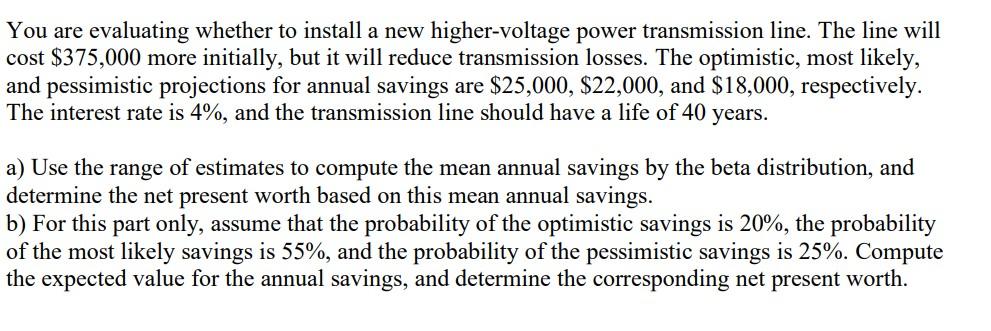

You are evaluating whether to install a new higher-voltage power transmission line. The line will cost $375,000 more initially, but it will reduce transmission losses. The optimistic, most likely, and pessimistic projections for annual savings are $25,000,$22,000, and $18,000, respectively. The interest rate is 4%, and the transmission line should have a life of 40 years. a) Use the range of estimates to compute the mean annual savings by the beta distribution, and determine the net present worth based on this mean annual savings. b) For this part only, assume that the probability of the optimistic savings is 20%, the probability of the most likely savings is 55%, and the probability of the pessimistic savings is 25%. Compute the expected value for the annual savings, and determine the corresponding net present worth

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts