Question: You are given a dataset in an Excel file by one of your Senior team members, Jack Rackham. This dataset consists of international portfolios. The

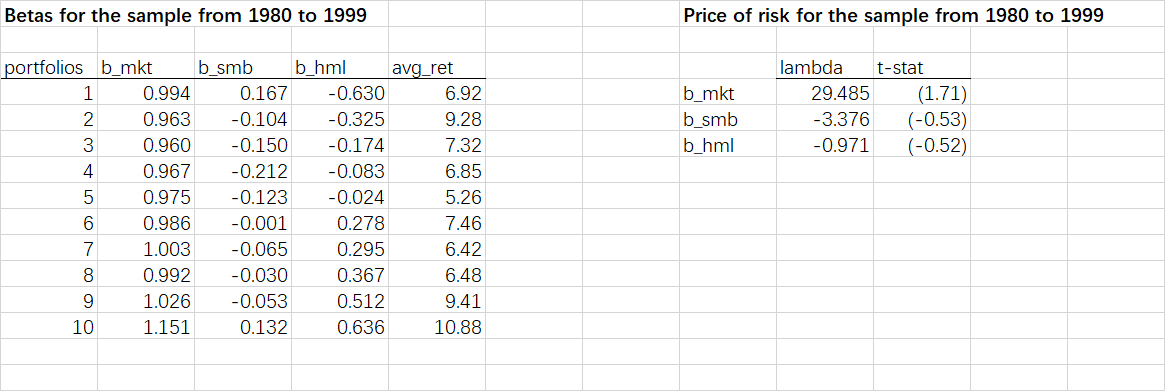

You are given a dataset in an Excel file by one of your Senior team members, Jack Rackham. This dataset consists of international portfolios. The Excel file contains international portfolio betas and the price of risk for two separate sample periods.

Your task is to create Power Point slides, so your team member Jack Rackham can give a quick presentation to the Fund Manager, Charles Vane. In the slides, you need to explain to Charles Vane whether he should create a new investment fund based on a value strategy.

1. You are given the unconditional betas for these 10 portfolios for both time-periods. What do these betas tell you in terms of risk? Are some portfolios riskier than others?

2. Now that you have analysed the data, recommend to Charles Vane whether he should create a fund based on a value strategy. Explain your reasoning.

Betas for the sample from 1980 to 1999 Price of risk for the sample from 1980 to 1999 lambda t-stat portfolios b_mkt b_smb b_hml avg_ret 1 0.994 0.167 -0.630 6.92 2 0.963 -0.104 -0.325 9.28 29.485 b_mkt b_smb b_hml -3.376 (1.71) (-0.53) (-0.52) 0.960 -0.150 -0.174 7.32 -0.971 0.967 -0.212 -0.083 6.85 0.975 -0.123 -0.024 5.26 OOOO OWN 0.986 -0.001 0.278 7.46 7 1.003 -0.065 0.295 6.42 0.992 -0.030 0.367 6.48 1.026 -0.053 0.512 9.41 1.151 0.132 0.636 10.88 Betas for the sample from 1980 to 1999 Price of risk for the sample from 1980 to 1999 lambda t-stat portfolios b_mkt b_smb b_hml avg_ret 1 0.994 0.167 -0.630 6.92 2 0.963 -0.104 -0.325 9.28 29.485 b_mkt b_smb b_hml -3.376 (1.71) (-0.53) (-0.52) 0.960 -0.150 -0.174 7.32 -0.971 0.967 -0.212 -0.083 6.85 0.975 -0.123 -0.024 5.26 OOOO OWN 0.986 -0.001 0.278 7.46 7 1.003 -0.065 0.295 6.42 0.992 -0.030 0.367 6.48 1.026 -0.053 0.512 9.41 1.151 0.132 0.636 10.88

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts